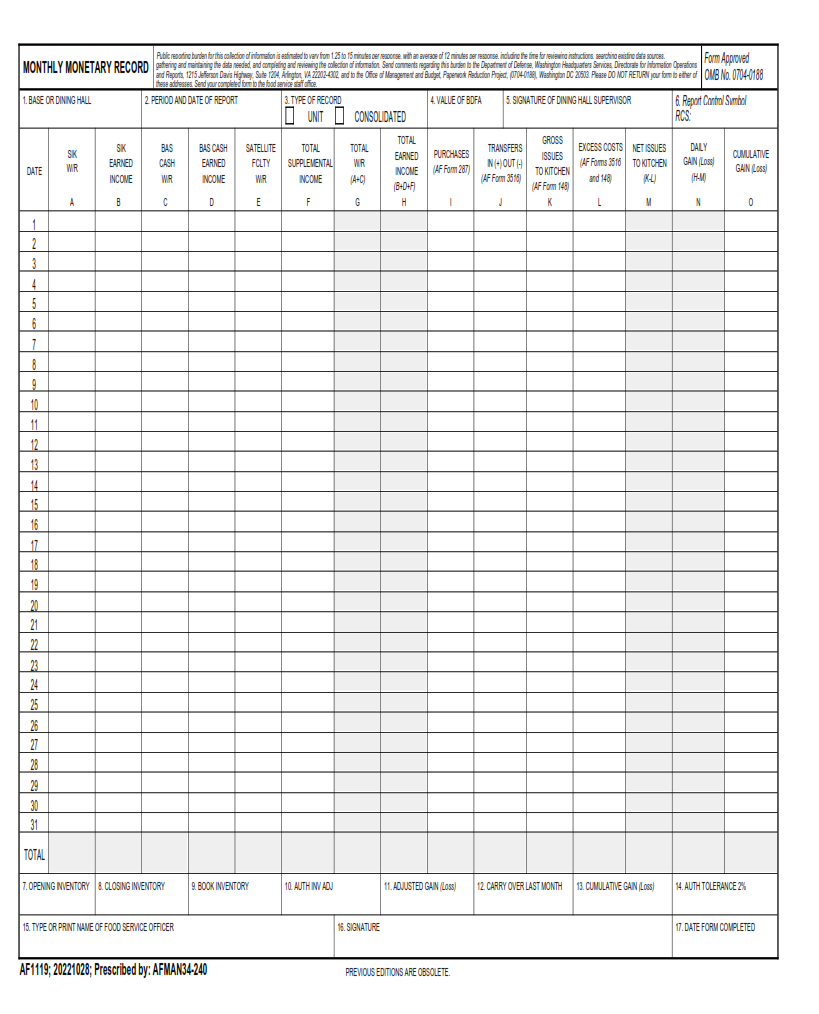

ORIGINFORMSTUDIO.COM – DAF Form 1119 – Monthly Monetary Records – DF-1119 is a report which is filed by most businesses and organizations to report their monetary transactions for the previous month. The DF-1119 should be filled out and submitted monthly, regardless of the number of transactions that took place. The purpose of the DF-1119 is to provide financial information for tax purposes.

Download DAF Form 1119 – Monthly Monetary Records

| Form Number | DAF Form 1119 |

| Form Title | Monthly Monetary Records |

| File Size | 60 KB |

| Form By | USPS Forms |

What is a DAF Form 1119?

DAF Form 1119 is used by employees of the Department of the Air Force to keep a record of their monthly monetary transactions. This form simplifies the process for tracking and recording all financial transactions, including cash receipts and disbursements, as well as other important financial information such as bank deposits, checks issued or received, and payroll deductions.

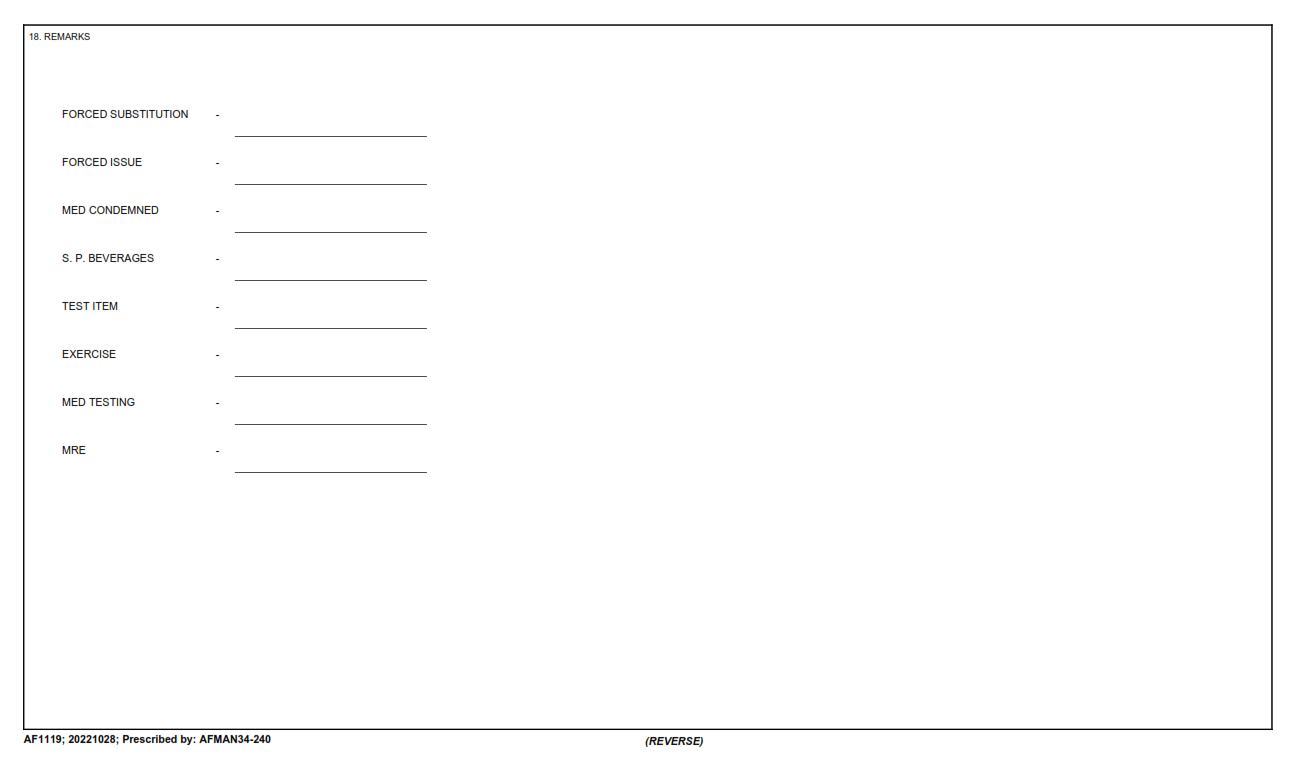

The DAF Form 1119 can be used in conjunction with other forms related to accounting and finance to ensure accurate record-keeping. The form includes a section for documenting any discrepancies or errors that may arise during the monthly reconciliation process. This helps ensure that any issues are resolved quickly and efficiently.

Overall, using the DAF Form 1119 is an effective way for employees within the Department of the Air Force to maintain accurate records of their financial transactions throughout each month. It provides a streamlined approach to accounting and bookkeeping while also offering an easy-to-use platform for monitoring monetary activities on a regular basis.

What is the Purpose of DAF Form 1119?

DAF Form 1119 is a crucial document for businesses that are required to report their monthly monetary records to the Department of Defense. The purpose of this form is to ensure that companies handling government contracts comply with the Federal Acquisition Regulation (FAR) and other applicable laws, regulations, and policies related to accounting and financial management.

The DAF Form 1119 requires companies to disclose all transactions made during the month, including payments received, expenses paid out, and any other financial activities related to government contracts. This information helps the government assess whether contractors are spending federal funds appropriately and in accordance with legal requirements.

By completing DAF Form 1119 accurately and on time each month, businesses can demonstrate their commitment to transparency and accountability in managing government contracts. Failure to submit this form or inaccurate reporting can result in penalties such as payment withholding or contract termination. Therefore, it is important for companies to understand the purpose of this form and comply with its requirements.

Where Can I Find a DAF Form 1119?

If you’re looking for a DAF Form 1119, there are several places you can find it. One option is to visit the IRS website and search for it using their online forms and publications search tool. Alternatively, you can contact your local IRS office or call their toll-free number and request a copy of the form.

You may also be able to find a DAF Form 1119 through your tax preparation software if you use one. Many popular tax software programs include access to various IRS forms that taxpayers may need, including the DAF Form 1119.

Lastly, if all else fails, consider reaching out to a tax professional or accountant who can assist you in obtaining a copy of the form or completing it on your behalf. It’s important to keep accurate records of all monetary transactions if you want to stay compliant with IRS regulations and avoid any potential penalties down the line.

DAF Form 1119 – Monthly Monetary Records

DAF Form 1119 is a monthly monetary record sheet that serves as an essential document for businesses in tracking their expenses and income. Accurate records of financial transactions can help business owners make informed decisions and stay on top of their cash flow. The DAF Form 1119 provides a structured format to record all the monetary transactions made during the month, including sales, purchases, payments, receipts, and other income.

This form also helps businesses to calculate their taxable income accurately by providing a clear overview of their overall revenue and expenses. By using this form regularly, business owners can easily identify any discrepancies or errors in their financial records and take corrective measures accordingly. It also simplifies the process of filing tax returns at the end of the fiscal year.

In conclusion, maintaining accurate records is critical for running a successful business. The DAF Form 1119 helps businesses stay organized with their finances while also facilitating compliance with tax laws. Businesses should ensure they complete this form every month to keep track of all monetary transactions and have up-to-date records at all times.

DAF Form 1119 Example