ORIGINFORMSTUDIO.COM – SBA Form 2233 – Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report – The Small Business Administration (SBA) Form 2233 is used to report loan loss reserves as part of the Premier Certified Lenders Program (PCLP). The SBA’s PCLP program is designed to help lenders maximize their ability to make loans to small businesses. Through this program, lenders are able to receive higher guarantee fees and access additional capital for lending activities. By submitting a quarterly loan loss reserve report, lenders can demonstrate their commitment to responsible lending practices and provide the SBA with detailed information about the loan programs they have implemented.

Download SBA Form 2233 – Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report

| Form Number | SBA Form 2233 |

| Form Title | Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report |

| File Size | 115 KB |

| Form By | SBA Forms |

What is an SBA Form 2233?

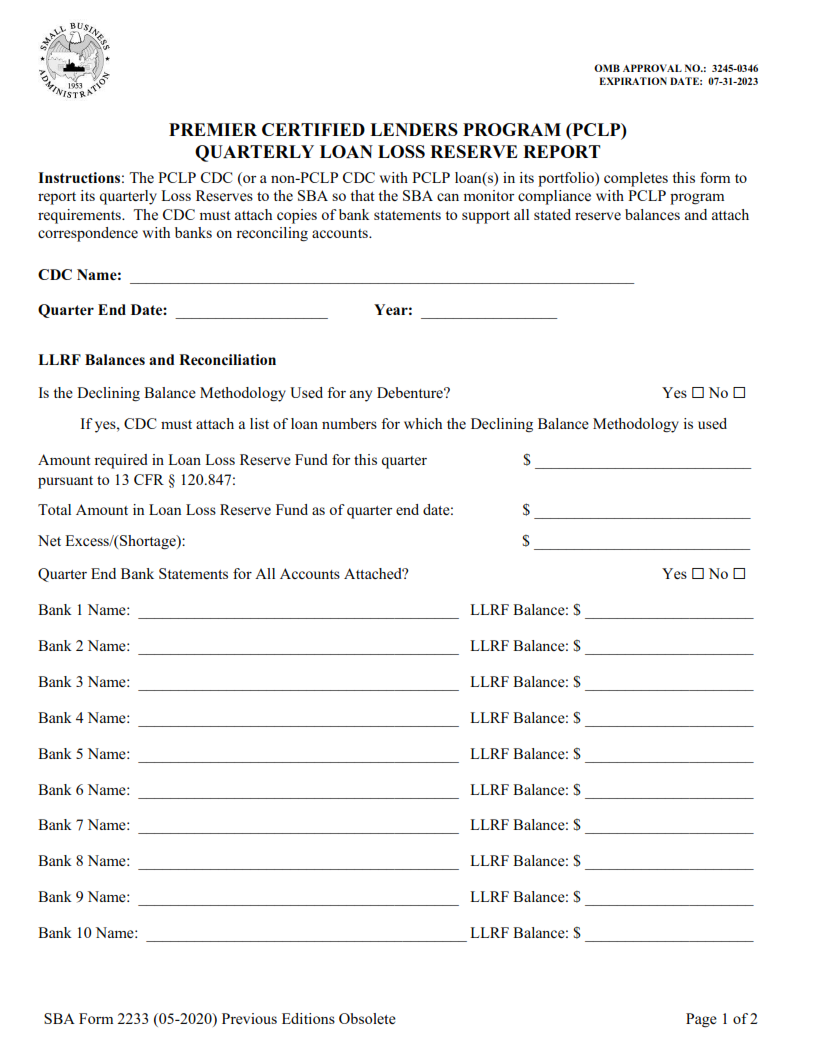

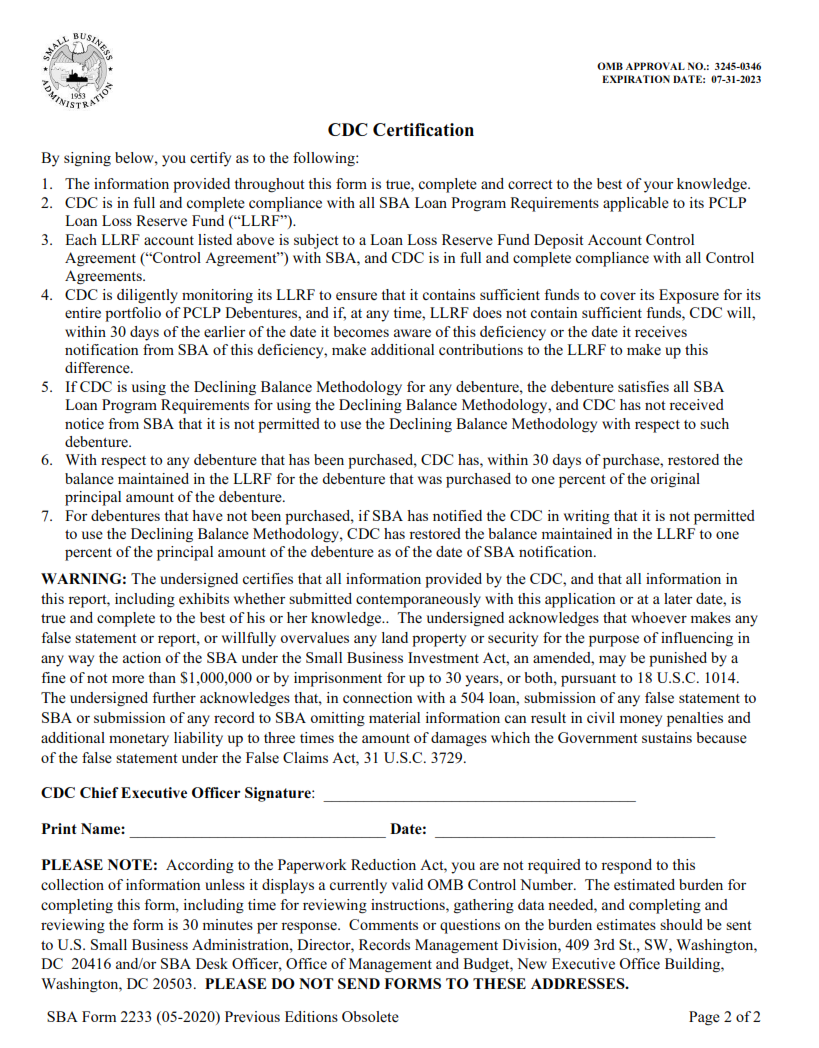

SBA Form 2233 is an important document used by the Premier Certified Lenders Program (PCLP) to track loan loss reserves. The form serves as a quarterly report that lenders must submit to the Small Business Administration (SBA). It provides a detailed account of all loans made through the PCLP, and any losses incurred from those loans.

The SBA Form 2233 is divided into two sections: Loan Information and Loss Reserve Information. In the Loan Information section, lenders must provide information about each loan’s original balance and maturity date, among other details. In the Loss Reserve Information section, lenders must provide details about any losses they have incurred on these loans over the quarter in question, including both principal and interest amounts.

What is the Purpose of SBA Form 2233?

The SBA Form 2233 is a quarterly report used by lenders to calculate the amount of loan loss reserves they need in order to participate in the Premier Certified Lenders Program (PCLP). This form is used to document and track losses experienced by the lender on SBA loans, as well as any other loans that are insured or guaranteed by the government. The purpose of this form is to help ensure that lenders have sufficient loan loss reserves to cover potential losses from these types of loans.

This form also provides an opportunity for lenders to analyze their financial performance and identify ways in which they can improve their operational efficiency. By utilizing this report, lenders can compare their current loss experience against past performance levels, allowing them to modify strategies as needed in order to reduce risk exposure. Additionally, this form serves as a valuable tool for regulators when conducting audits and reviews of lending operations.

Where Can I Find an SBA Form 2233?

The Small Business Administration’s (SBA) Form 2233, also known as the Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report, is an important part of the application process for lenders wanting to become SBA approved. This form outlines how much a lender must set aside in reserves to cover potential loan losses.

The form can be found on the official SBA website. In order to locate it, users should first navigate to the SBA Forms page and then select “Forms & Applications” from the drop-down menu. On this page, users will find a link for PCLP Quarterly Loan Loss Reserve Reports which includes Form 2233. After downloading the PDF file, users should print out one copy for each lender so that they may submit them along with their other PCLP documents.

SBA Form 2233 – Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report

The SBA Form 2233, also known as the Premier Certified Lenders Program (PCLP) Quarterly Loan Loss Reserve Report, is a form used by lenders participating in the Small Business Administration’s PCLP program. This form is used to report loan loss reserves data required for reporting purposes under the SBA’s 7(a) loan program. The report must be submitted on a quarterly basis and includes information about loan losses incurred during the previous quarter.

The contents of this form require lenders to provide detailed information regarding their loan loss reserve balance including total loans covered by qualified loss reserves at the end of each reporting period and any adjustments made to those reserves during that period. This form also requires lenders to provide details on how they are calculating the appropriate loan loss reserves, such as an analysis of past performance or current market conditions.

SBA Form 2233 Example