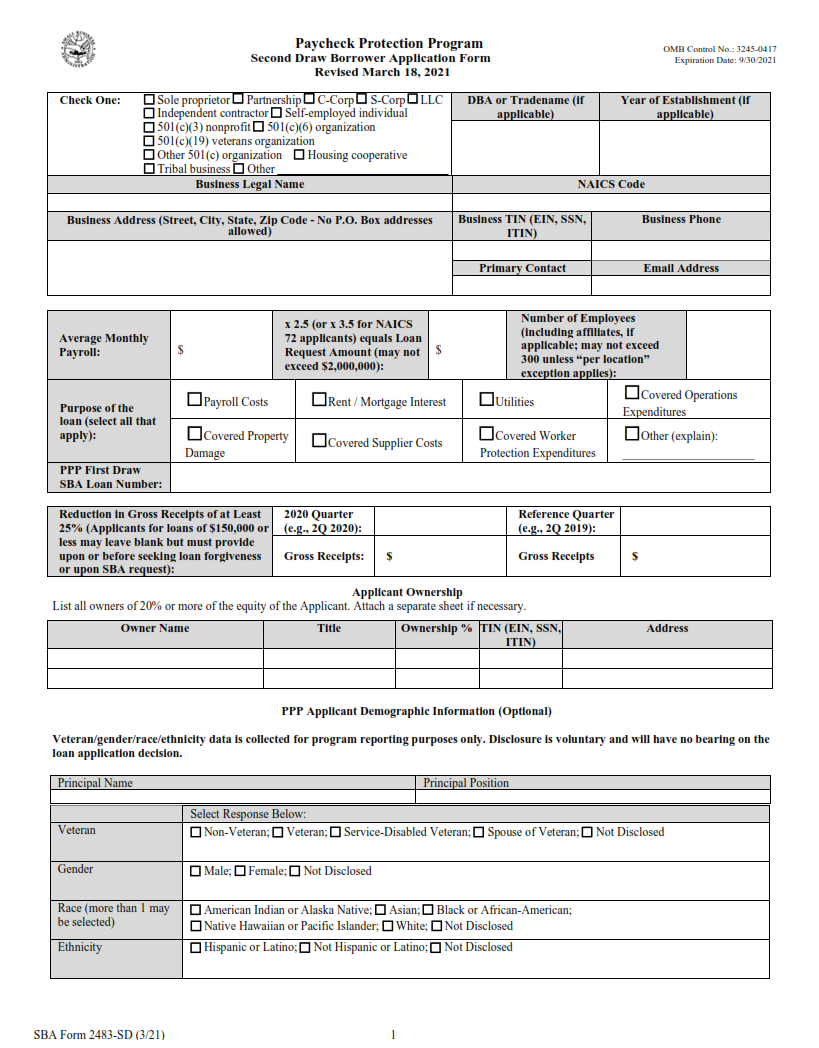

ORIGINFORMSTUDIO.COM – SBA Form 2483-SD – PPP Second Draw Borrower Application Form – The Small Business Administration (SBA) Paycheck Protection Program (PPP) Second Draw Borrower Application Form, also known as Form 2483-SD, is an important document for small business owners who are looking to receive additional financial assistance. This form requires detailed information about the borrower and their business in order to determine eligibility for PPP loan funding. With a number of changes to the program since its initial rollout in 2020, it is essential that applicants understand the requirements and necessary steps when utilizing this form.

Download SBA Form 2483-SD – PPP Second Draw Borrower Application Form

| Form Number | SBA 2483-SD |

| Form Title | PPP Second Draw Borrower Application Form |

| File Size | 577 KB |

| Form By | SBA Forms |

What is an SBA Form 2483-SD?

The SBA Form 2483-SD is the application form used by eligible small businesses to apply for a second draw loan under the Paycheck Protection Program (PPP). This form will be used to document the borrower’s eligibility, projected use of funds, and other relevant information required under the program.

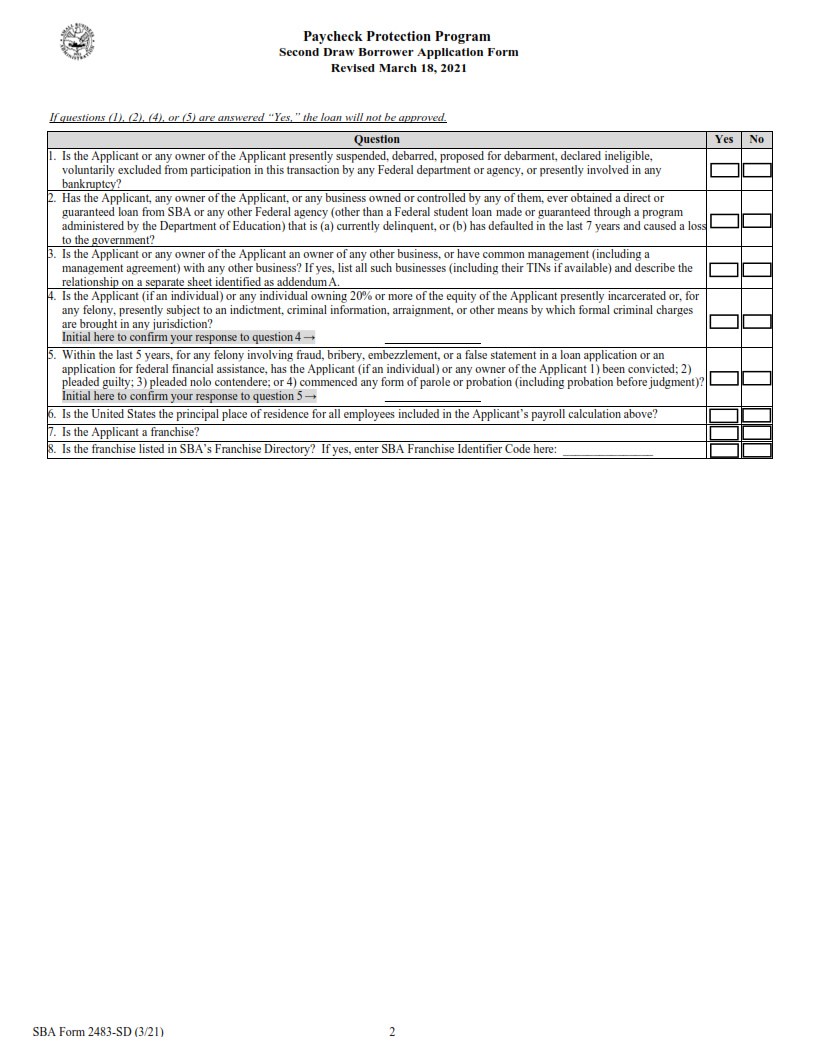

The SBA Form 2483-SD must be completed and signed by all eligible borrowers seeking a Second Draw PPP Loan. The form includes questions about business ownership, number of employees, revenue losses related to COVID-19, a description of how the loan proceeds will be used and other pertinent information. Additionally, applicants must certify that their answers are accurate and complete in order for the SBA to determine their eligibility for a PPP Second Draw Loan.

What is the Purpose of SBA Form 2483-SD?

The Small Business Administration (SBA) Form 2483-SD is a borrower application form for certain businesses applying for the Paycheck Protection Program (PPP) Second Draw loan. The purpose of the form is to provide basic information about the business and its owners so that the lender can determine eligibility for the loan.

The form requires borrowers to provide detailed financial data and records, such as bank statements, payroll, tax returns, and other documents related to their business. This information will be used by lenders to evaluate an applicant’s creditworthiness and capacity to repay the loan. The form also requires borrowers to provide detailed information regarding their use of funds from prior PPP loans in order to assess how they are using those funds towards eligible expenses.

Where Can I Find an SBA Form 2483-SD?

The Small Business Administration (SBA) Form 2483-SD is a form used to apply for a Paycheck Protection Program (PPP) Second Draw Borrower loan. It contains important information about the borrower, such as the amount of the loan being requested and how the funds will be used.

The SBA offers this form on their website so that businesses can quickly and easily apply for a PPP Second Draw Borrower loan. The form can also be downloaded from other websites that specialize in helping businesses understand and complete forms related to U.S. government programs. Additionally, many financial institutions will have copies of this form available online or in person at their branches, allowing borrowers to obtain it without having to search online.

SBA Form 2483-SD – PPP Second Draw Borrower Application Form

The Small Business Administration (SBA) recently released the SBA Form 2483-SD, commonly referred to as the PPP Second Draw Borrower Application Form. This form is designed to help businesses that have already received a Paycheck Protection Program (PPP) loan apply for another one. It is important to note that only certain businesses are eligible for this loan, so it’s critical to determine if your business meets all of the requirements before applying.

The application itself is relatively straightforward and can be completed in just a few steps. First, you will need to provide information about your business’s size and number of employees, as well as other details about its operations. Then, you will need to enter data such as revenue and expenses from 2019 or 2020 and indicate whether or not you have applied for an EIDL Advance or PPP Loan previously.

SBA Form 2483-SD Example