ORIGINFORMSTUDIO.COM – SBA Form 3507 – PPP Lender Agreement (Non-Bank) – The SBA Form 3507 – PPP Lender Agreement (Non-Bank) is an important document for non-bank lenders seeking to participate in the Paycheck Protection Program (PPP). The CARES Act of 2020 created the PPP as a means to provide financial assistance to small businesses affected by the COVID-19 pandemic. This form provides instructions on how non-bank lenders can become approved participants in this program and outlines the terms of their agreement with the Small Business Administration. It is an essential part of ensuring that businesses receive the funding they need during these difficult times.

Download SBA Form 3507 – PPP Lender Agreement (Non-Bank)

| Form Number | SBA 3507 |

| Form Title | PPP Lender Agreement (Non-Bank) |

| File Size | 598 KB |

| Form By | SBA Forms |

What is an SBA Form 3507?

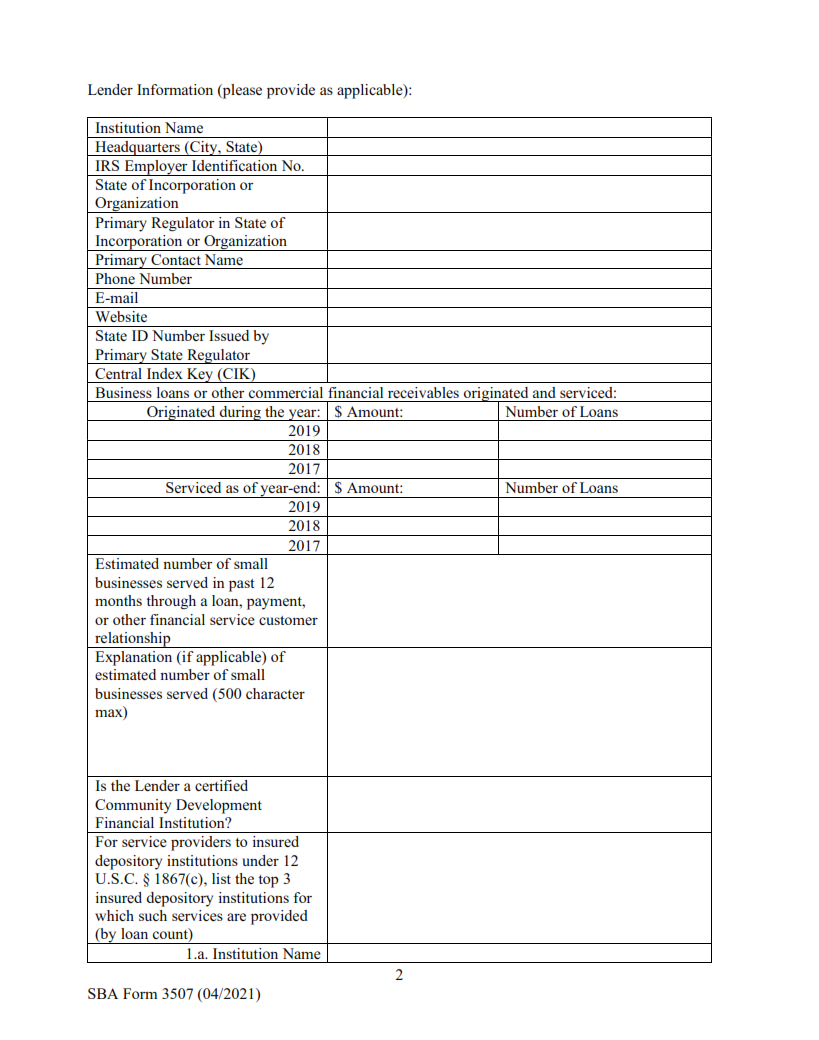

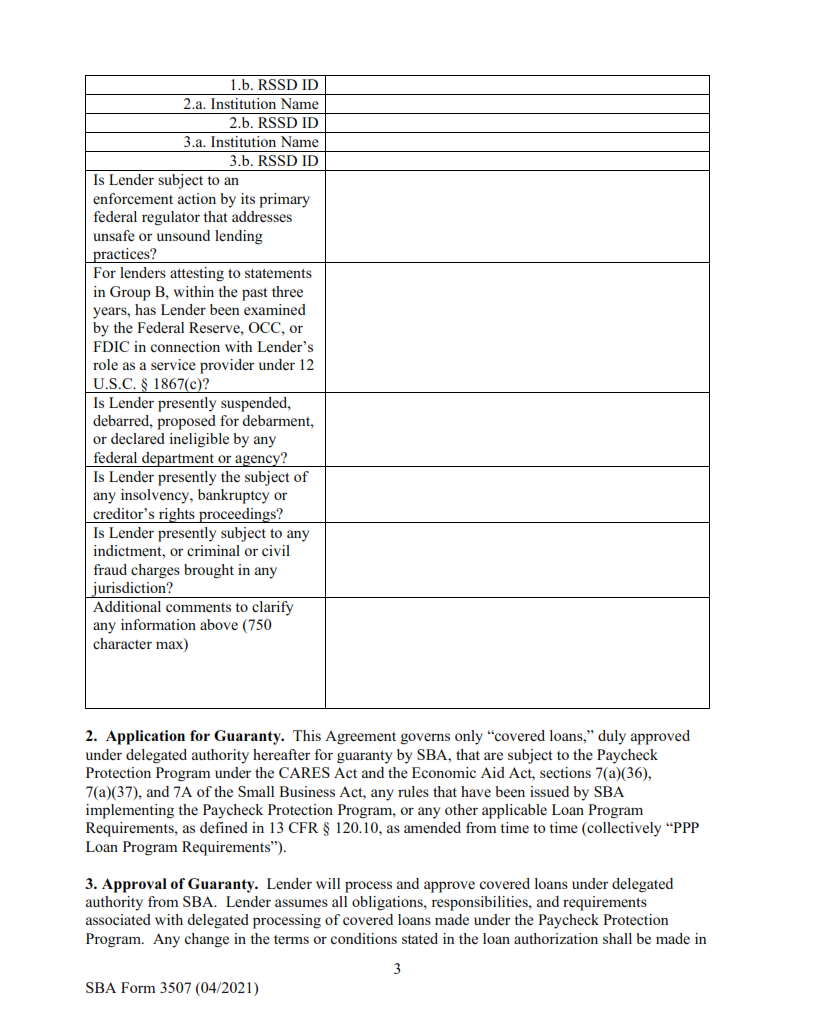

An SBA Form 3507 is a legally binding agreement between a lender and the Small Business Administration (SBA). This form is used when applying for a Paycheck Protection Program loan, also known as a PPP loan. It outlines the terms of the loan agreement and requires both parties to sign off on it before any money can be disbursed. The form must be completed by all lenders who wish to participate in the SBA’s PPP program.

This document serves as an official contract between lender and borrower, detailing all relevant information about the loan amount, interest rate, repayment terms, and other important details. Lenders are required to provide accurate information when completing this form, so that borrowers have an understanding of what they are signing up for before accepting any funds from them.

What is the Purpose of SBA Form 3507?

The SBA Form 3507 is a crucial document for lenders participating in the Paycheck Protection Program (PPP). This form, also known as the PPP Lender Agreement, is used to certify that a lender is approved by the Small Business Administration (SBA). It provides clear instructions on how to process PPP loans and outlines lenders’ responsibilities.

By signing this agreement, lenders agree to comply with all of the SBA’s regulations and policies regarding loan origination and servicing. Additionally, lenders must provide certain information about their business operations and history when submitting Form 3507. This includes detailed information such as business name, address, tax ID number, total amount of loans originated under the program, etc.

Where Can I Find an SBA Form 3507?

The SBA Form 3507, or the PPP Lender Agreement (Non-Bank), is a form that lenders who are not banks must fill out in order to receive funding under the Paycheck Protection Program (PPP). This agreement details the terms of the loan and is necessary for all non-bank lenders to submit. It is important to note that this form is only applicable to non-bank lenders – banks should use Form 3508 instead.

The SBA Form 3507 can be found on the Small Business Administration website, as part of their “Forms & Publications” section. This page contains all of the relevant forms related to loans and grants provided by the SBA, including both Bank and Non-Bank PPP lender agreements. The form itself can also be downloaded directly from this page as a PDF file.

SBA Form 3507 – PPP Lender Agreement (Non-Bank)

The SBA Form 3507 – PPP Lender Agreement (Non-Bank) is a form that must be completed by a non-bank lender in order to participate in the Paycheck Protection Program (PPP). This form outlines the terms and conditions of participating in the PPP, as well as detailing what information must be collected from borrowers. It also provides instructions on how to complete and submit the application. The form also includes a signature page for both the lender and borrower, which is required for any approved loans. All non-bank lenders who wish to offer PPP loans must sign this agreement before they can begin processing applications.

In addition to agreeing to comply with all relevant federal regulations, non-banks should make sure they understand the provisions of this agreement before signing it.

SBA Form 3507 Example