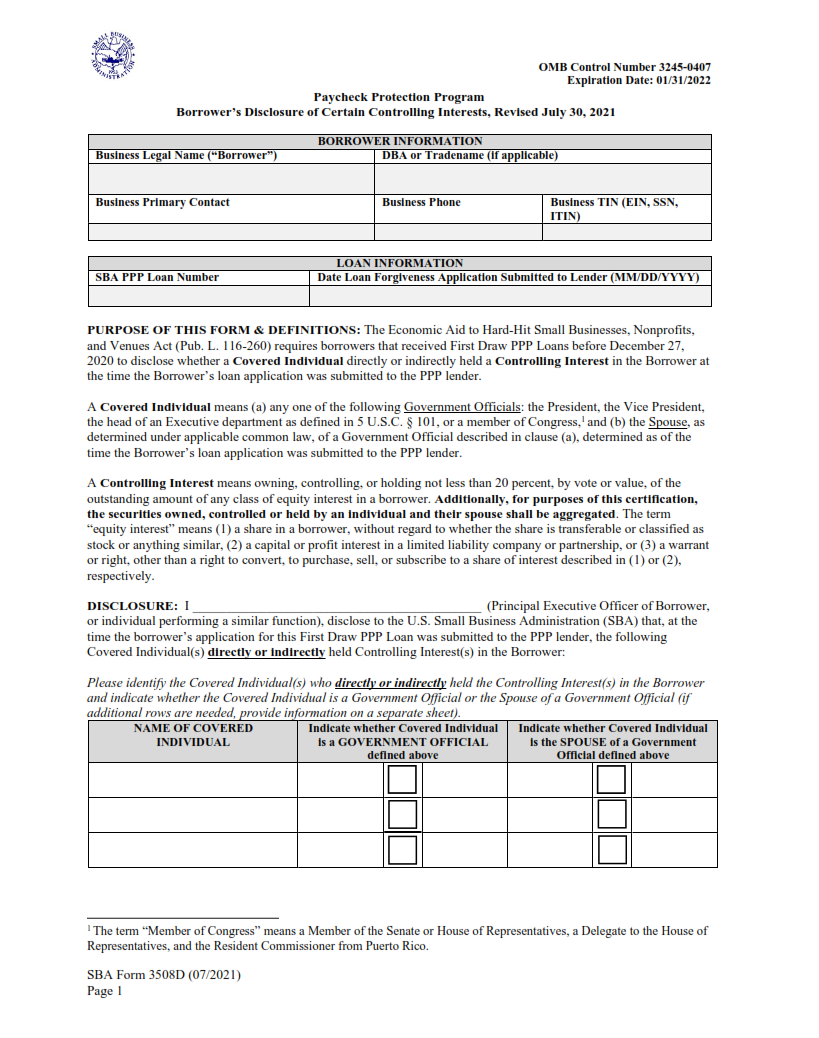

ORIGINFORMSTUDIO.COM – SBA Form 3508D – Paycheck Protection Program Borrower’s Disclosure of Certain Controlling Interests – The Small Business Administration (SBA) has recently launched the Paycheck Protection Program (PPP) to support small businesses during the COVID-19 pandemic. To apply for this program, one of the documents that must be completed is Form 3508D: Paycheck Protection Program Borrower’s Disclosure of Certain Controlling Interests. This article will provide an overview of the form, including who should complete it and what information is required when filling it out.

Download SBA Form 3508D – Paycheck Protection Program Borrower’s Disclosure of Certain Controlling Interests

| Form Number | SBA 3508D |

| Form Title | Paycheck Protection Program Borrower’s Disclosure of Certain Controlling Interests |

| File Size | 290 KB |

| Form By | SBA Forms |

What is an SBA Form 3508D?

The Small Business Administration (SBA) Form 3508D is a disclosure form used by borrowers of the Paycheck Protection Program. It helps the SBA identify any parties related to a loan recipient who have a controlling interest in the company. This includes non-affiliated shareholders and other controlling interests with an ownership stake of at least 20%. This information is necessary for the SBA to assess eligibility for PPP loan funding.

Completing this form is mandatory for applicants who are applying for or are engaged in a PPP loan, and it must be signed by all affected members of an organization that holds a controlling interest. In addition, borrowers may need to provide additional documents such as tax returns, bank statements, and business licenses to demonstrate their eligibility as well.

What is the Purpose of SBA Form 3508D?

The SBA Form 3508D is a disclosure form created by the Small Business Administration (SBA) specifically for businesses that have received loans through the Paycheck Protection Program. The purpose of this form is to help ensure compliance with certain regulations surrounding the program, as well as to provide transparency and accountability among borrowers.

This form requires businesses to disclose any “controlling interests” that could influence decisions made in regards to their loan. This includes any individual or organization who owns more than 20% of the equity in a business, holds a majority voting interest, or has control over significant operations and processes within an organization. By collecting this information, the SBA can better monitor how funds are being used and ensure they are being applied appropriately.

Where Can I Find an SBA Form 3508D?

An SBA Form 3508D is available for borrowers of the Paycheck Protection Program (PPP) to disclose certain controlling interests. This form must be completed by business owners, or those with a controlling interest in their company, and submitted to the Small Business Administration (SBA).

The SBA has made the form available online on its website. To access it, users should navigate to the “Forms” section of the website and select “Loan Programs & Services.” From there, they will find a link to download Form 3508D. Additionally, borrowers can request to receive a copy of this form from their lender or other participating financial institution.

Once completed, this form should be returned to the lender that provided your PPP loan or directly submitted to SBA’s Office of Disaster Assistance along with all other required documents.

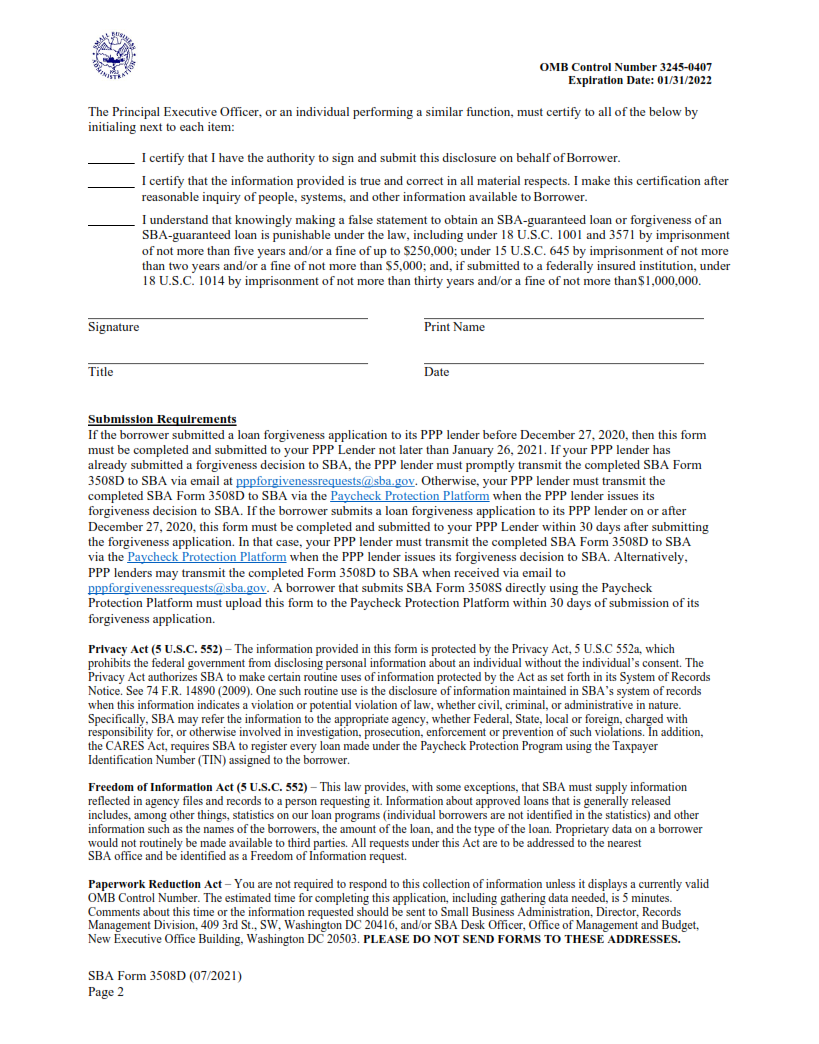

SBA Form 3508D – Paycheck Protection Program Borrower’s Disclosure of Certain Controlling Interests

The Small Business Administration (SBA) recently released the SBA Form 3508D to help protect borrowers of the Paycheck Protection Program (PPP). This form requires disclosure of certain controlling interests held by an Applicant, owner, or Affiliate. A controlling interest is defined as more than 50% ownership or control of a business entity. The purpose of this form is to ensure that only eligible individuals and entities receive PPP loans.

In addition to disclosing any controlling interests, applicants must also list all owners with greater than 20% ownership in the business applying for a loan. Additionally, any Affiliates who have received funds under the CARES Act or other SBA 7(a) loan programs must be identified on this form. This includes any owners of those businesses as well as their controlling interest holders.

SBA Form 3508D Example