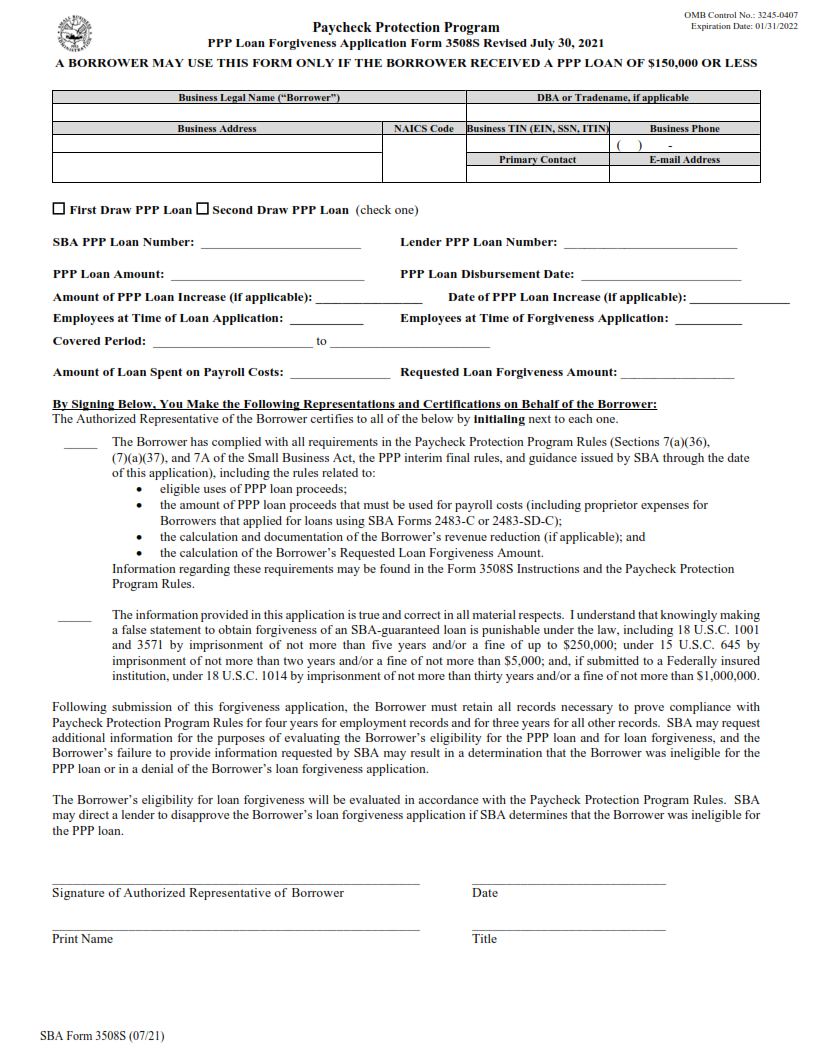

ORIGINFORMSTUDIO.COM – SBA Form 3508S – PPP 3508S Loan Forgiveness Application + Instructions – The Paycheck Protection Program (PPP) has been an important source of financial relief for business owners during the Covid-19 pandemic. One of the critical forms to be aware of if you have received a PPP loan is Form 3508S – PPP Loan Forgiveness Application. This article will provide detailed instructions on how to complete this form accurately and effectively. Here, we’ll go over the eight sections that need to be filled out, as well as some tips on preparing for forgiveness and collecting any necessary documentation needed in order to submit your application.

Download SBA Form 3508S – PPP 3508S Loan Forgiveness Application + Instructions

| Form Number | SBA Form 3508S |

| Form Title | PPP 3508S Loan Forgiveness Application + Instructions |

| File Size | 364 KB |

| Form By | SBA Forms |

What is an SBA Form 3508S?

SBA Form 3508S is an application for loan forgiveness through the Paycheck Protection Program (PPP). It was created by the U.S. Small Business Administration (SBA) to help small businesses and nonprofit organizations affected by the COVID-19 pandemic receive financial assistance. The form must be completed and submitted to an approved SBA lender, who will review and approve it if all eligibility criteria are met.

The form requires information about a business’s payroll costs, number of employees, average salary during the covered period, and other expenses that may qualify for loan forgiveness. In order to be eligible for full or partial loan forgiveness, businesses must use at least 60% of their PPP funds on payroll costs during the covered period.

What is the Purpose of the SBA Form 3508S?

The SBA Form 3508S is an important document for businesses who have received loans from the Paycheck Protection Program (PPP). This form allows businesses to apply for loan forgiveness and outline their expenses related to the loan. Businesses must certify that their expenses were used for specific purposes in order to qualify for loan forgiveness.

The purpose of the SBA Form 3508S is to provide a clear understanding of how funds from PPP loans have been spent by businesses. Businesses must be able to show that they used at least 60 percent of their loan amount on payroll costs, and any remaining funds must be allocated towards utility payments, rent, or mortgage interest payments. The form also requires accurate documentation such as receipts, invoices and bank statements so it is important that all information provided is accurate and up-to-date.

Where Can I Find an SBA Form 3508S?

The Small Business Administration (SBA) Form 3508S is the loan forgiveness application form for the Paycheck Protection Program (PPP). This form must be completed and submitted to your lender in order to apply for forgiveness of your PPP loan. The form can be found on the SBA’s website, as well as on many other websites that provide information about government forms. Additionally, you may be able to obtain a copy from your lender or financial institution.

When filling out the SBA Form 3508S, it is important to make sure all of your information is correct and up to date. You will need to provide basic details about your business such as name, address, tax ID number, and contact information.

SBA Form 3508S – PPP 3508S Loan Forgiveness Application + Instructions

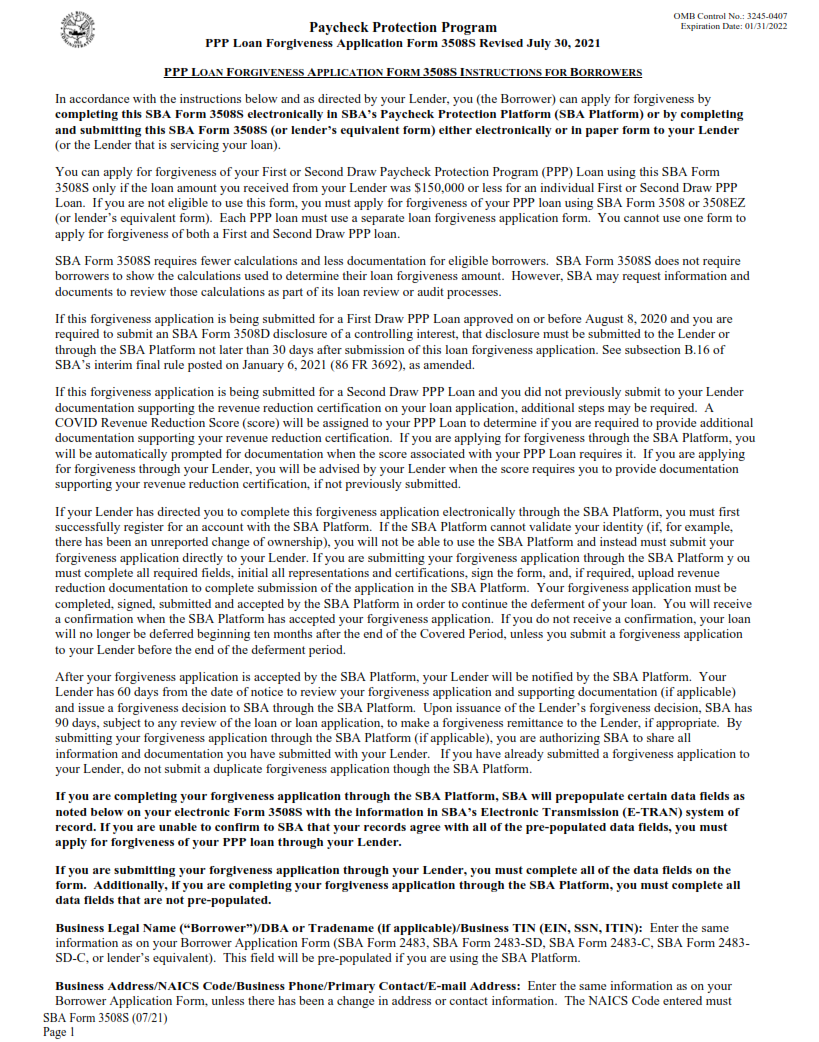

The Small Business Administration (SBA) Form 3508S is a loan forgiveness application for the Paycheck Protection Program (PPP). It is used to apply for partial or total forgiveness of PPP loans. The form includes detailed instructions on how to properly complete and submit the application.

In order to apply for loan forgiveness, borrowers must provide supporting documentation such as payroll records, tax documents, business income and expenses, and other relevant information. Borrowers should also make sure they accurately calculate eligible payroll costs and non-payroll costs as these are key factors in determining loan forgiveness amount. In addition, borrowers will need to certify that all documents are accurate and complete according to SBA guidelines.

Finally, borrowers must sign and date their applications before submission. Once submitted, lenders will review the application and notify applicants of their decision within 60 days.

SBA Form 3508S Example