ORIGINFORMSTUDIO.COM – VTR-346 – Texas Motor Vehicle Transfer Notification – The VTR-346 is a form provided by the Texas Department of Motor Vehicles that must be completed when any vehicle transfer takes place in the state of Texas. This notification form serves important legal purposes, including providing proof of ownership and protecting both parties involved in the transaction from potential liabilities. It is also used to ensure that taxes are paid on vehicles being sold or transferred; this helps generate resources for state programs and services. The VTR-346 is an important document for anyone buying, selling, or transferring a car within Texas borders and should be filled out accurately and completely.

Download VTR-346 – Texas Motor Vehicle Transfer Notification

| Form Number | VTR-346 |

| Form Title | Texas Motor Vehicle Transfer Notification |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-346 Form?

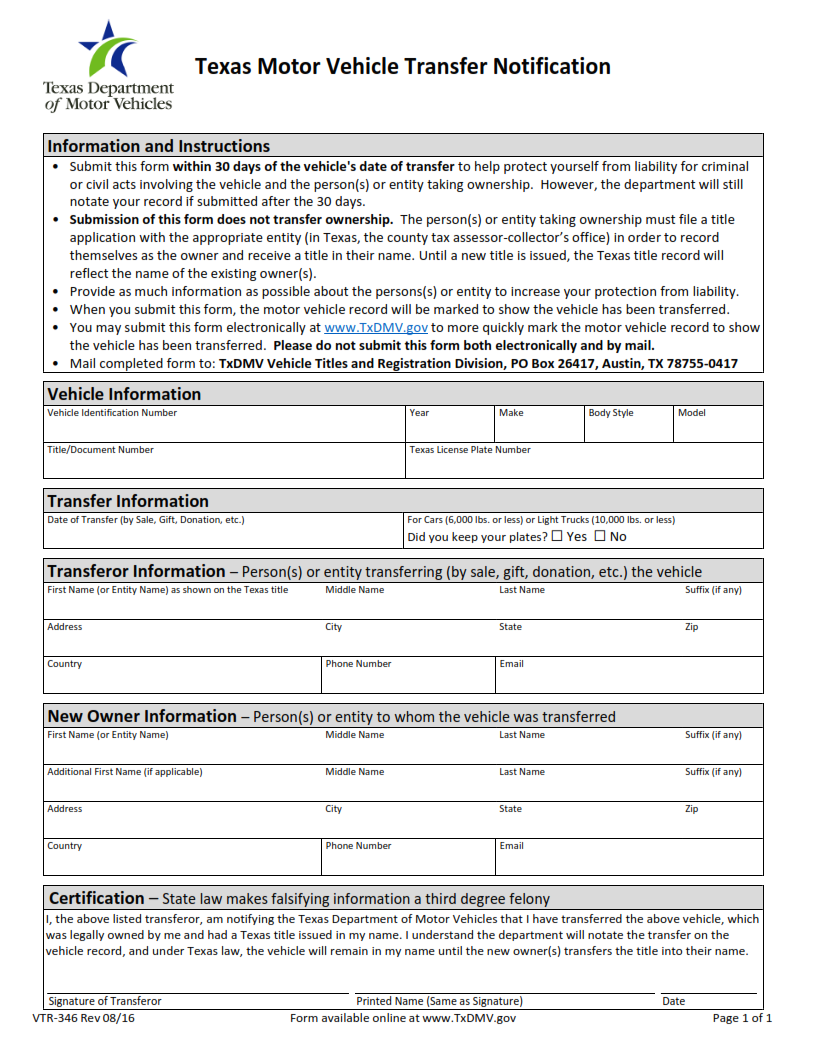

A VTR-346 is a form issued by the state of Texas to notify the local county tax assessor-collector that a vehicle or trailer has been transferred. This form must be completed and submitted within 30 days of the transfer, or the individual transferring ownership of the vehicle may be subject to a penalty fee.

The VTR-346 can be obtained from any county tax office in Texas, as well as online from several popular websites. Once completed, it must include information about both the buyer and seller, including name, address, date of birth, driver’s license number, phone number and email address. It also requires details about the vehicle itself such as make/model/year information and identification numbers (VIN). The form should also include signatures from both parties acknowledging that ownership has been transferred.

What is the Purpose of the VTR-346 Form?

The VTR-346 is a form issued by the Texas Department of Motor Vehicles (DMV). It serves as a notification that an individual has transferred ownership of a motor vehicle in the state of Texas. This form must be completed and submitted to the DMV within 30 days of the transfer or sale of the motor vehicle.

The purpose of this form is threefold: it documents that ownership has legally been transferred, provides proof that taxes have been paid on behalf of both parties involved in the transaction, and verifies all information related to both seller and buyer such as their name, address, driver’s license number (or personal identification number), and vehicle description. This helps ensure that no fraudulent activity takes place during any transactions involving vehicles in Texas.

Where Can I Find a VTR-346 Form?

Finding a VTR-346 form is quite easy and can be done in two different ways. The first way is to visit your local Texas Department of Motor Vehicles office. Here, you can obtain the form for free and it will be printed on official government paper. Not only will this ensure that your form is valid, but it also ensures that all of the information on the form is up-to-date with current laws and regulations.

The second way to get a VTR-346 Form is to print one out online from the Texas DMV website. This option allows you to have an electronic version of the form without having to leave your home or office. Once you have completed all necessary fields, simply submit it directly through their website for processing.

VTR-346 – Texas Motor Vehicle Transfer Notification

The Texas Motor Vehicle Transfer Notification, VTR-346, is a document that must be completed whenever a vehicle is bought or sold in the state of Texas. The purpose of this form is to ensure the appropriate transfer of ownership and to provide necessary information for taxing purposes.

The seller must complete the top portion of the VTR-346 form and sign it when transferring ownership. This portion requires basic information about both buyer and seller, as well as details about the vehicle including its make, model, year, and Vehicle Identification Number (VIN). The buyer then signs off on their purchase by completing their section as well. It’s important that all sections are accurately filled out in order for tax authorities to properly assign taxes owed on the vehicle purchase.

VTR-346 Form Example