ORIGINFORMSTUDIO.COM – VTR-436 – Owner Retained Report – The VTR-436 Owner Retained Report is an important report for anyone looking to purchase a property and understand its true value. Generated by the appraiser, the report provides essential information to help the buyer make an informed decision when purchasing a home or other real estate. It serves as a record of the current condition of the property and assists in determining whether it is worth what is being asked for. This article will explore how to interpret this detailed report, which includes factors such as location, neighborhood values, size and amenities of the property, among others.

Download VTR-436 – Owner Retained Report

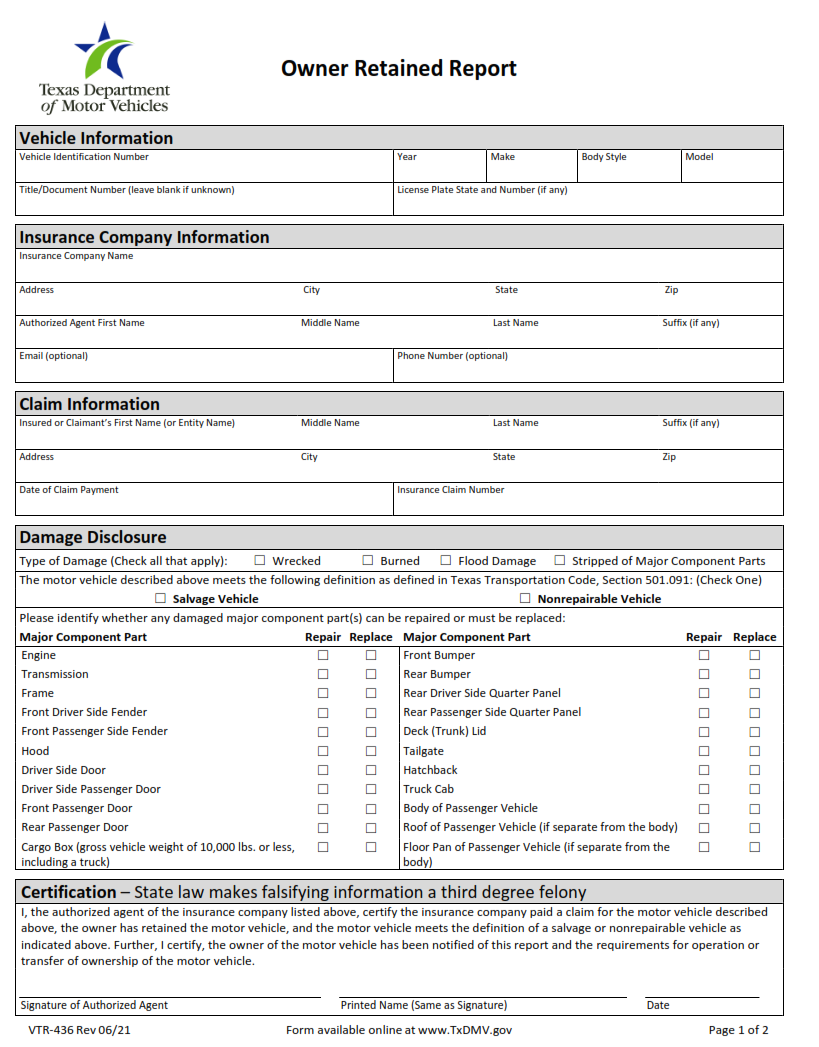

| Form Number | VTR-436 |

| Form Title | Owner Retained Report |

| File Size | 2 MB |

| Form By | Texas DMV Form |

What is a VTR-436 Form?

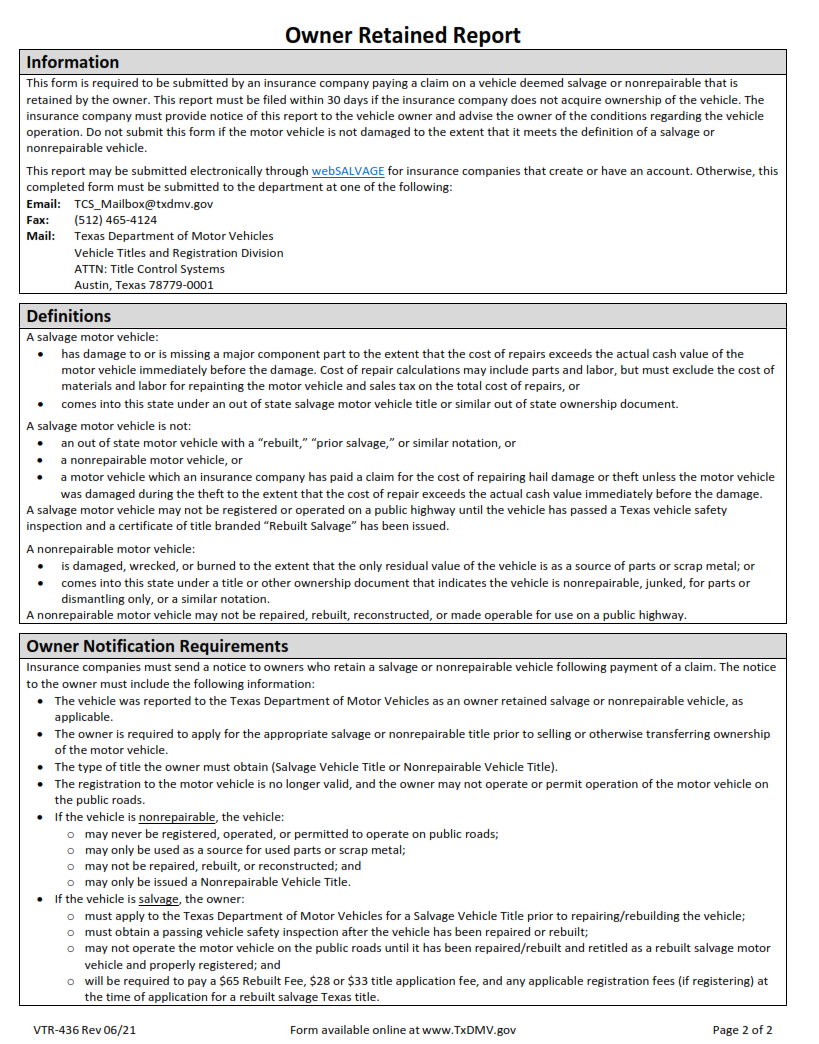

The VTR-436 form, also known as the Owner Retained Report, is an official document used by Texas vehicle owners to prove they have maintained financial responsibility over their vehicle. This form must be submitted to the Texas Department of Motor Vehicles (TxDMV) in order to obtain or renew a vehicle registration. The VTR-436 form allows owners to declare that they are financially responsible for any damages resulting from an accident involving a motor vehicle registered under their name. It also serves as proof that the owner has liability insurance coverage on their registered motor vehicles.

The VTR-436 form must be filled out with all relevant information about the vehicle and its owner such as make, model, year and license plate number. Furthermore, it requires details about the insurance policy including type of coverage, policy limits and dates of coverage.

What is the Purpose of the VTR-436 Form?

The VTR-436 form, also known as the Owner Retained Report, is an important document used by vehicle owners in Texas. This form is required when transferring ownership of a vehicle in the state. It serves two purposes: to provide detailed information about the sale and to protect both parties involved in the transaction.

The VTR-436 form requires both the buyer and seller of a used vehicle to fill out personal information, including their name and address. The form also requires details about the condition of the car, such as repairs made in the past year and any outstanding liens on it. Additionally, buyers must submit proof that they have purchased insurance for their newly acquired vehicle before submitting this paperwork to obtain registration documents from their local county tax office or Texas Department of Motor Vehicles (TxDMV).

Where Can I Find a VTR-436 Form?

The VTR-436 form, also known as the Owner Retained Report, is a document used by the Texas Department of Motor Vehicles (TxDMV) to record an ownership transfer between two parties. The form must be completed and submitted when transferring title or registration of a vehicle from one owner to another.

The VTR-436 form can be obtained through the TxDMV website or at any local county tax office. Once completed and signed by both parties, it must then be submitted along with payment for any applicable taxes and fees due at the time of transfer. If either party chooses to retain ownership in part or full, they must indicate this on the form as well. Lastly, if either party requires proof of title retention after submitting the VTR-436 form, they may request a copy from their local county tax office once the transaction has been processed.

VTR-436 – Owner Retained Report

The VTR-436 Owner Retained Report is an important document related to the sale of real estate in Virginia. This report, which must be completed by the seller, provides potential buyers with a comprehensive overview of all property improvements or alterations made during the seller’s ownership. It also helps protect both parties involved in a sale by providing documentation that can be used later on in any legal disputes.

The VTR-436 document covers all major work done to the home since its purchase, including any additions, renovations and repairs. Homeowners must provide detailed descriptions of each alteration and provide specific dates for when the work was done. They must also include photographs that show before and after shots of each improvement or alterations made throughout their ownership period. Additionally, homeowners are required to disclose any known defects in their property such as structural issues or pest infestations.

VTR-436 Form Example