ORIGINFORMSTUDIO.COM – VTR-904 – License Plate Transfer Form – VTR-904 is an important form for those who need to transfer a license plate from one motor vehicle to another. This document is used by the Texas Department of Motor Vehicles (TxDMV) and must be completed in order for the transfer of the license plate to take place. It’s important that individuals understand all of the requirements associated with VTR-904, as well as what information will need to be provided on the form.

Download VTR-904 – License Plate Transfer Form

| Form Number | VTR-904 |

| Form Title | License Plate Transfer Form |

| File Size | 4 MB |

| Form By | Texas DMV Form |

What is a VTR-904 Form?

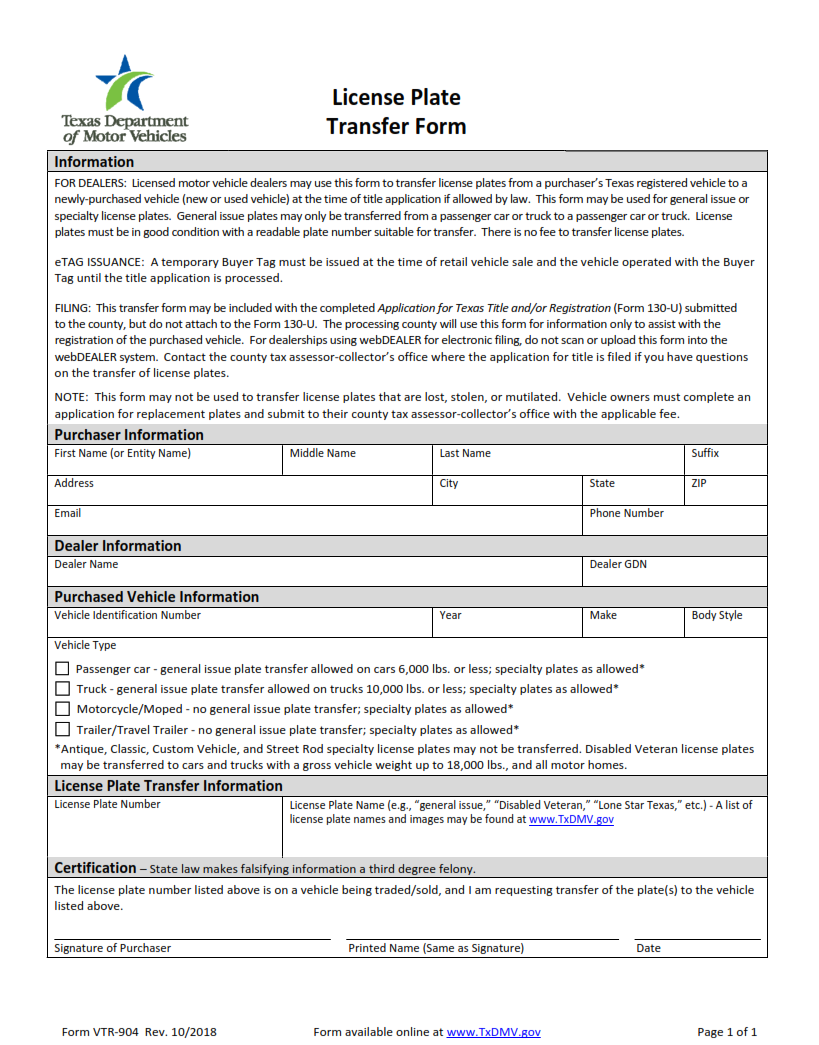

The VTR-904 form, also known as the Texas License Plate Transfer Form, is an essential document for transferring a vehicle’s license plate in the state of Texas. It is required to transfer a license plate from one vehicle to another or when transferring ownership of a vehicle with existing plates. The form must be filled out by both parties involved in the transaction and properly notarized before it can be submitted to the county tax office.

On the VTR-904 form, both parties provide their personal information and sign off on all relevant sections regarding the transfer of license plates. This includes confirming that all taxes have been paid and that any liens associated with the vehicle have been released. In addition, both parties are required to declare that all statements given are true under penalty of perjury as outlined by Section 37.10 of the Texas Penal Code.

What is the Purpose of the VTR-904 Form?

The VTR-904, also known as the Texas License Plate Transfer Form, is a form used to transfer license plate ownership from one person to another. The purpose of this form is to ensure that all legal procedures are followed when transferring ownership of a vehicle’s license plates. This form allows individuals and companies to transfer ownership of their vehicles without any hassles or delays.

The VTR-904 must be completed in full and submitted to the state Department of Motor Vehicles (DMV). It requires information about both parties involved in the transaction such as name, address, phone number, and driver’s license number for each party. It also requires specific details about the vehicle being transferred including make, model year, current mileage reading, and title/registration numbers.

Where Can I Find a VTR-904 Form?

The VTR-904 is an official license plate transfer form used by the Texas Department of Motor Vehicles (TxDMV). This form must be completed when transferring a vehicle’s license plate from one person to another. The VTR-904 can be found online at the TxDMV website or in person at any county tax office.

When completing the VTR-904, make sure to include information about both parties involved in the transaction. This includes their full name and contact information, as well as the vehicle’s make, model, and year of manufacture. Additionally, both parties must sign and date the form before it can be accepted by the TxDMV. Once all required information is present on the form, it can then be submitted either in person or via mail to a county tax office for processing.

VTR-904 – License Plate Transfer Form

The VTR-904 – License Plate Transfer Form is a crucial document for drivers in the state of Texas. This form must be filled out and signed by both parties involved in exchanging vehicle plates, no matter if it’s a transfer between family members or the sale of a vehicle to another driver.

Before submitting the form, make sure to carefully read through all instructions on the reverse side and fill out all sections completely and accurately. The process begins with providing basic information such as name, address, contact information, license plate numbers, and other identifying information about both vehicles. In addition to this necessary info, you’ll also need to include details about any liens that may be attached to either vehicle. Once all sections are filled out correctly and signatures have been obtained from both parties involved in the transaction, submit the form at your local tax office along with any applicable fees.

VTR-904 Form Example