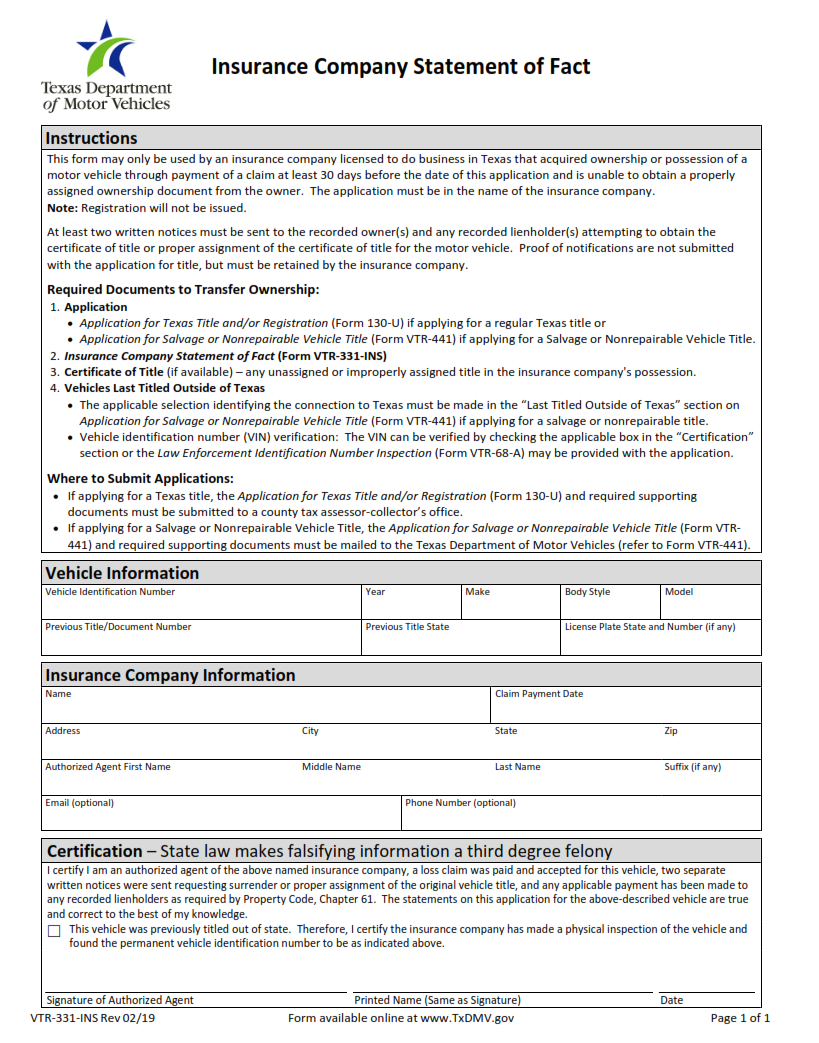

ORIGINFORMSTUDIO.COM – VTR-331-INS – Insurance Company Statement of Fact – This article will provide the necessary information regarding the VTR-331-INS statement of fact, issued by an insurance company. This document is a detailed representation of the facts and accounts associated with a specific policyholder. It outlines important details related to coverage, premium rates, payment methods and other essential elements of the agreement between insurer and insured. Additionally, it serves as evidence should any disputes or discrepancies arise in relation to the respective policy. As such, understanding this document is paramount for anyone considering taking out an insurance policy from this particular provider.

Download VTR-331-INS – Insurance Company Statement of Fact

| Form Number | VTR-331-INS |

| Form Title | Insurance Company Statement of Fact |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-331-INS Form?

A VTR-331-INS form is a form issued by the Texas Department of Motor Vehicles. It is used to provide proof of automobile insurance coverage when registering your vehicle in the state of Texas. The form can be obtained from any insurance company licensed to do business in the state or online from the Texas DMV website.

The VTR-331-INS document must include information such as the name and address of both parties, vehicle identification number, liability coverage details, and effective dates for each policy listed on this form. Furthermore, it must also be signed by an authorized representative of the insurer and contain their name, title, telephone number and email address if available. The purpose of this document is to prove that you have current auto insurance before you are allowed to register your vehicle with the state and obtain license plates.

What is the Purpose of the VTR-331-INS Form?

The VTR-331-INS form is a document used by the Texas Department of Motor Vehicles (TxDMV) to verify that an insurance company has issued automobile liability coverage for a particular vehicle. The purpose of this form is to provide assurance that all registered vehicles in Texas are covered and compliant with state law.

This document must be completed and submitted by the insurer along with the vehicle owner’s application for registration or renewal. It includes information such as policy number, effective dates, type of coverage offered, name and address of insured, name of insurer and other details required by TxDMV. Once submitted and approved, it serves as proof that the vehicle meets all necessary requirements for operation on public roads within Texas.

Where Can I Find a VTR-331-INS Form?

The VTR-331-INS form is a document that must be filled out and submitted to the Texas Department of Motor Vehicles (TxDMV) in order to register certain types of vehicles. This form is required for registration of motor homes, camper trailers, travel trailers, house cars, and other miscellaneous vehicle types issued by an insurance company. The VTR-331-INS can be obtained from many places including the TxDMV website or through an insurance agent or company.

When filling out the VTR-331-INS form it’s important to provide accurate information about the vehicle being registered as well as its owner and insurer. Once filled out correctly it should be submitted to either a local county tax office or mailed directly to TxDMV for processing along with other necessary documents such as proof of insurance and payment for registration fees.

VTR-331-INS – Insurance Company Statement of Fact

The VTR-331-INS is a statement of fact issued by most insurance companies that outlines the coverage and conditions of an insurance policy. This document is required for coverage to be effective and serves as the official source for information about a given insurance policy.

The VTR-331-INS contains important details such as what type of insurance coverage is included, any deductible amounts, and other special provisions or limits on the policy. It also includes contact information for filing claims or for making changes to the policy. This document should be read carefully before signing it so that all parties involved understand their responsibilities under the agreement.

It’s important to remember that this document does not replace any existing personal contracts between insured parties, nor does it affect the original terms of an existing contract in any way.

VTR-331-INS Form Example