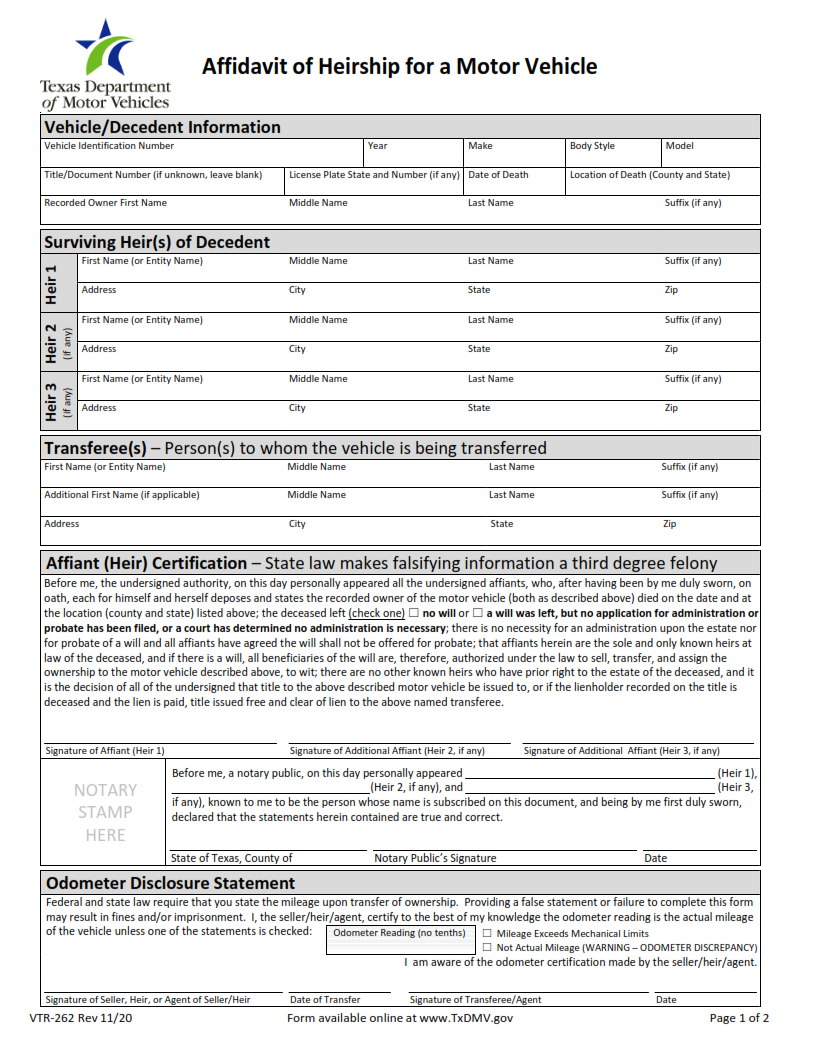

ORIGINFORMSTUDIO.COM – VTR-262 – Affidavit Of Heirship For A Motor Vehicle – When a person passes away, their assets need to be distributed amongst their heirs. One of the most common types of assets to be settled is the ownership of a motor vehicle. Transferring the title from the deceased owner to their proper heir requires paperwork and an affidavit proving that the individual is indeed entitled to take control of it. This article explains the process for filing VTR-262 – Affidavit Of Heirship For A Motor Vehicle in order for individuals to take legal possession over a car that was previously owned by another person.

Download VTR-262 – Affidavit Of Heirship For A Motor Vehicle

| Form Number | VTR-262 |

| Form Title | Affidavit Of Heirship For A Motor Vehicle |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-262 Form?

A VTR-262 is an affidavit of heirship for a motor vehicle form issued by the Texas Department of Motor Vehicles (TXDMV). It is used to establish proof of ownership and title when there is no known owner or lienholder. The affidavit must be completed, notarized, and submitted to the TXDMV with all supporting documentation.

The required information includes: name and address of the deceased person; name and address of each heir; relationship between each heir and deceased person; make, model, year and vehicle identification number (VIN) for the motor vehicle; signature of each affiant claiming interest in the motor vehicle; a statement that all heirs have agreed to designate one individual as being responsible for transfer or sale of the motor vehicle.

What is the Purpose of the VTR-262 Form?

The purpose of the VTR-262 form is to document a transfer of ownership for a motor vehicle when the original owner has died without leaving a will. The form is used to help provide evidence that establishes an heir’s right to take possession and ownership of the motor vehicle in question. In Texas, this form also functions as an affidavit which declares that the claimant filing it is entitled to inherit ownership rights over the motor vehicle and can use it as proof of ownership in order to title, register, and insure it.

The VTR-262 form requires detailed information regarding the deceased person’s name, date of death, county where death occurred, and other details about their estate status. It must also include information about any potential heirs who are related by blood or marriage such as names and addresses along with details about any assets left behind by the deceased person.

Where Can I Find a VTR-262 Form?

Finding a VTR-262 form can be confusing, but fortunately it’s available online. The Texas Department of Motor Vehicles (TxDMV) offers the form on its official website for free. The VTR-262 is an Affidavit of Heirship for a Motor Vehicle that must be completed in order to establish ownership in cases where there is no title or surviving owner.

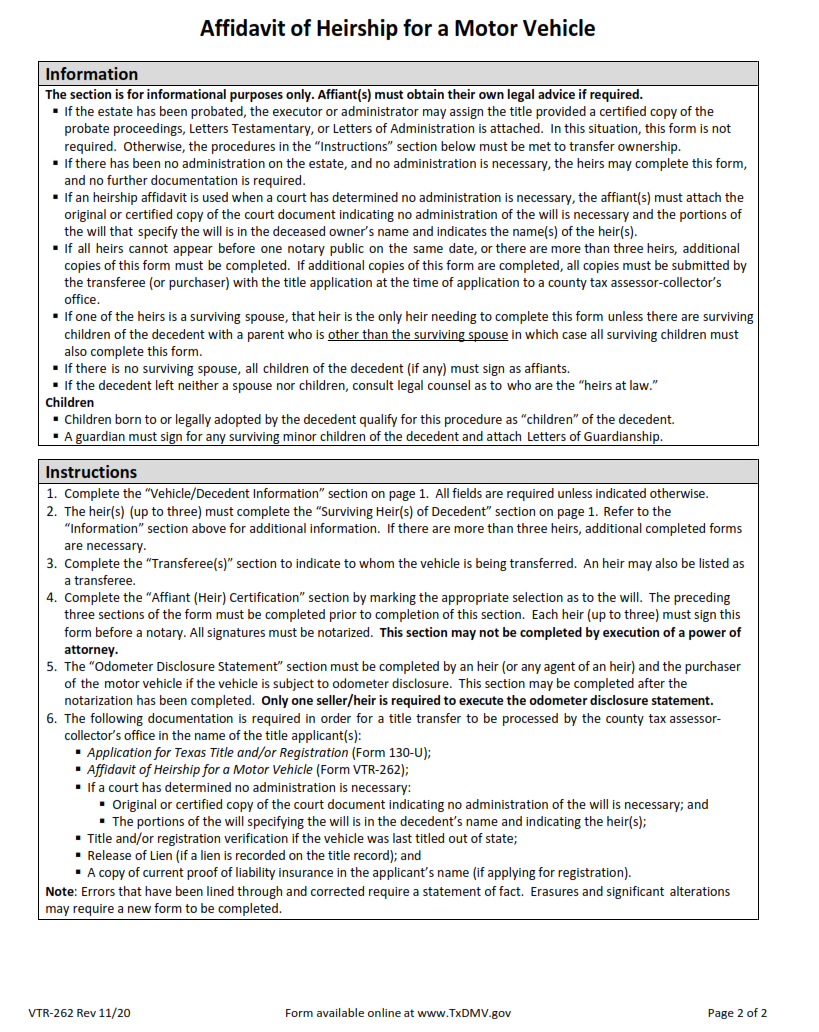

It’s important to note that the VTR-262 must only be completed if instructed by the TxDMV County Tax Office or other authorized title service providers. All information included on the form must be accurate and complete, as any mistakes will delay or void approval by the TxDMV. If you need help completing the form, you should contact your local county tax office for guidance.

VTR-262 – Affidavit Of Heirship For A Motor Vehicle

When a motor vehicle is transferred after the death of the owner without probate, an affidavit of heirship must be completed in order to transfer title. The VTR-262 form, issued by the Texas Department of Motor Vehicles (TxDMV), serves as an affidavit of heirship for a motor vehicle and is required in certain circumstances.

The VTR-262 form must be completed and submitted to TxDMV with all necessary documentation to transfer title when the deceased person left no will or did not name an executor. It is also used when there was a will, but it does not direct how the motor vehicle should be distributed. In addition to being signed by all parties involved, this form requires proof that at least one heir has paid inheritance tax on their share of the decedent’s estate before they can receive their portion of any assets.

VTR-262 Form Example