ORIGINFORMSTUDIO.COM – VTR-50-A – Application for Registration Fee Credit – The VTR-50-A is a new type of television receptor that was recently introduced by Sony. This new device can be used to watch free over-the-air TV channels without having to purchase a digital TV tuner. The VTR-50-A requires an external antenna and can be used with any television that has an A/V input. The registration fee credit offered by Sony allows consumers to receive a refund of the $40 registration fee for the VTR-50-A.

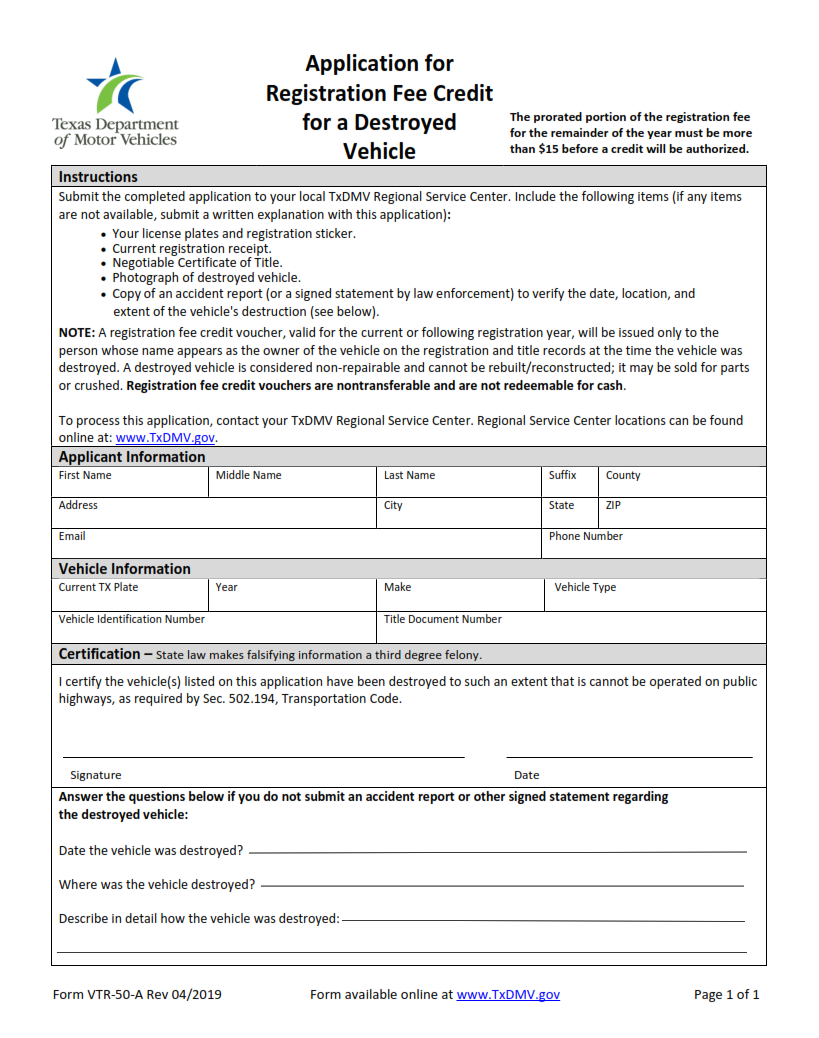

Download VTR-50-A – Application for Registration Fee Credit

| Form Number | VTR-50-A |

| Form Title | Application for Registration Fee Credit |

| File Size | 2 MB |

| Form By | Texas DMV Form |

What is a VTR-50-A Form?

The VTR-50-A document is an application for registration fee credit. The purpose of the form is to allow the Department of State to reflect any discrepancies between the registration fees paid and the amount of fees that should be refunded. The form must be submitted within 60 days after legal permanent resident status has been granted, or within 60 days after an adjustment to legal permanent resident status is made.

What is the Purpose of VTR-50-A Form?

The VTR-50-A form is used by businesses that have registered for the Business Tax Rebate Program. The form requests information about the business, such as its name, contact information and registration number. Once this information is verified, the business will receive a refund of its registration fee.

Where Can I Find a VTR-50-A Form?

The VTR-50-A form is the application for registration fee credit. It needs to be filled out by the property owner and submitted to the county assessor’s office. The Form VTR-50-A can be obtained from the county assessor’s office, or from the Department of Taxation.

VTR-50-A – Application for Registration Fee Credit

There are a few things to keep in mind if you are interested in applying for a registration fee credit on your VTR-50-A. The first is that the credit is only available to residents of the United States. Additionally, the credit can only be used for registration fees paid after October 1, 2017. Finally, the amount of the credit varies depending on which state you live in. The table below shows the maximum amount of credits that can be claimed per state:

State Maximum Credit Amount Alabama $200 Alaska $200 Arizona $300 Arkansas $200 California $600 Colorado $300 Connecticut $500 Delaware $200 Florida $400 Georgia $300 Hawaii $700 Idaho $300 Illinois $1000 Indiana $400 Iowa$ 200 Kansas$ 400 Kentucky$ 300 Louisiana$ 300 Maine$ 1000 Maryland$ 900 Massachusetts$ 1000 Michigan$ 1100 Minnesota$ 500 Mississippi.

VTR-50-A Form Example