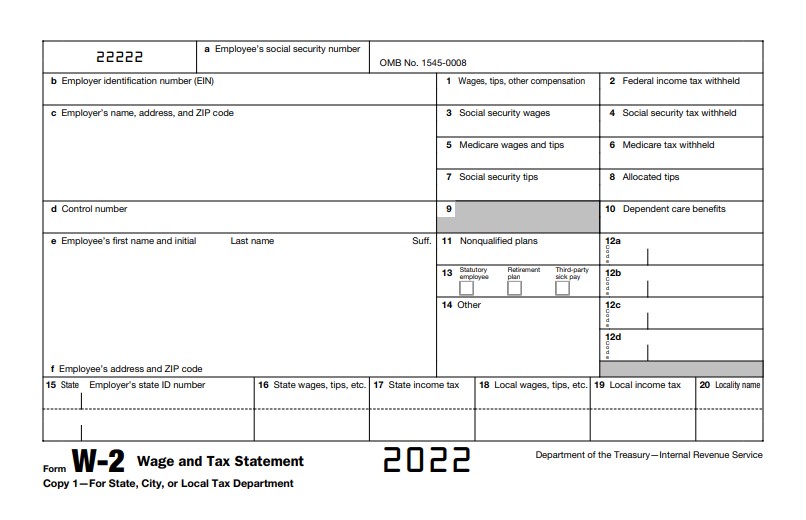

W2 Form 2022 Printable – Looking for the inside scoop on your income and taxes? Look no further than the W2 Form 2022 – Wage and Tax Statement! This essential document tells you everything you need to know about your earnings and withholdings from the past year, making it a must-have for anyone looking to get a handle on their finances. With its clear and concise layout, the W2 Form 2022 is the perfect tool for anyone looking to stay on top of their financial game. So what are you waiting for? Get this crucial document today and start taking control of your financial future!

What is W2 Form?

The W2 Form is a crucial document for employees and employers in the United States. It is used to report an employee’s earnings and taxes withheld by their employer and is typically issued annually. The W2 Form provides employees with important information about their income for the year. It is also used by the Internal Revenue Service (IRS) to verify that employers have properly reported employee earnings and taxes withheld. This document helps employees and employers comply with federal and state tax laws.

The W2 Form contains information about an employee’s earnings and taxes, including the total amount earned during the year, federal and state taxes withheld, and other details such as contributions to retirement plans and other benefits. The form also includes the employer’s name and address and the employee’s name, address, and Social Security number. Employees need this information to accurately file their income tax returns, while employers use the W2 Form to report employee earnings and taxes to the government.

The W2 Form is a vital document for anyone who works for an employer in the United States. It provides employees with important information about their income and taxes and helps ensure employers comply with tax laws. By properly completing and submitting the W2 Form each year, employees and employers can stay on top of their finances and avoid any potential legal or financial issues related to taxes.

How do I write a W-2 For a 2022 Tax Year?

To fill out a W2 Form for the 2022 tax year, you must gather certain information for your employees, including their names, Social Security numbers, and total earnings. You must also calculate federal and state taxes withheld from each employee’s annual paycheck. How do I write a W-2 For a 2022 Tax Year? Follow these steps:

- Gather employee information: For each employee, you’ll need to collect their name, Social Security number, and total earnings for the year.

- Calculate taxes withheld: Determine the total federal and state taxes withheld from each employee’s paycheck during the year.

- Obtain W-2 Forms: The Internal Revenue Service (IRS) provides W-2 Forms that you can use to report employee earnings and taxes withheld. You can order them online or pick them up at a local IRS office.

- Fill out the form: Use the information you collected to fill out the W-2 Form for each employee. Double-check all information for accuracy, including employee name and Social Security number.

- Submit the forms: Send a copy of each employee’s W-2 to the Social Security Administration (SSA) and provide a copy to the employee for their records.

- File with the IRS: Submit all W-2 Forms to the IRS, along with a copy of Form W-3 (Transmittal of Wage and Tax Statements), which summarizes the total earnings and taxes withheld for all employees.

- Keep records: Keep a copy of all W-2 Forms and related documents for your records. It’s important to maintain accurate records for at least four years in case of an audit.

How do I file a W-2?

To file a W-2, follow these steps:

- Complete the W-2 Form: The W-2 Form reports an employee’s wages and taxes withheld by their employer. Be sure to fill out the form accurately, including the employee’s name, Social Security number, total earnings, and taxes withheld.

- Submit copies to the Social Security Administration (SSA): You must send Copy A of the W-2 Form to the SSA by the deadline. You can submit it online through the SSA’s Business Services Online website or by mail using Form W-3 (Transmittal of Wage and Tax Statements).

- Provide copies to employees: You must give each employee a copy of their W-2 Form by the deadline. Employees need this form to file their income tax returns with the IRS.

- File with the state: Some states require employers to file copies of W-2 Forms with their state tax agency. Check with your state tax agency to determine if this is required.

- File with the IRS: You must file Copy A of all W-2 Forms and Form W-3 with the IRS by the deadline. You can submit the forms electronically using the IRS’s Business Services Online website or by mail.

The deadline for submitting W-2 Forms varies depending on the year and filing method. For the 2022 tax year, the deadline to submit Copy A of the form to the SSA is January 31, 2023. The deadline to provide copies to employees is also January 31, 2023, and the deadline to file with the IRS is March 31, 2023, if filing electronically or February 28, 2023, if filing by mail.

Failure to file W-2 Forms accurately and on time can result in penalties and legal issues. It’s recommended to consult with a tax professional or use a reputable tax software program to ensure that your W-2 Forms are properly filed.

Do I need to Issue a W-2C?

You might need to issue a W-2C (Corrected Wage and Tax Statement) if you made errors on an employee’s original W-2 Form. Here are some situations where you may need to issue a W-2C:

- Incorrect employee information: If you made errors on the employee’s name, Social Security number, or other identifying information, you must issue a corrected form.

- Incorrect earnings or taxes withheld: If you made errors on the employee’s earnings or taxes withheld, you’d need to issue a corrected form.

- Filing with the wrong state: If you filed the original W-2 Form with the wrong state, you’d need to issue a corrected form for the correct state.

- Issuing multiple W-2 Forms: If you accidentally issued multiple W-2 Forms to the same employee, you must issue a corrected form to show the correct earnings and taxes withheld.

If you need to issue a W-2C, follow these steps:

- Obtain the W-2C Form: The W-2C Form corrects errors on an employee’s original W-2 Form. You can obtain the form from the Internal Revenue Service (IRS) website.

- Complete the form: Fill out the form accurately, including the employee’s correct information, earnings, and taxes withheld.

- Submit the form: Send Copy A of the W-2C Form to the Social Security Administration (SSA) and provide a copy to the employee for their records. You may also need to file a corrected form with your state tax agency and the IRS.

It’s important to issue a W-2C as soon as possible to avoid legal or financial issues. If you’re unsure whether to issue a W-2C, consult a tax professional or contact the IRS for guidance.

W2 Form 2022 Printable

Download & Print – W2 Form 2022 [PDF].