ORIGINFORMSTUDIO.COM – SBA Form 1150 – Offer in Compromise – The Small Business Administration (SBA) offers a form for small business owners called the Form 1150 – Offer in Compromise. This form is designed to help businesses settle their debt with the SBA and other creditors. The settlement offer must be accepted by the creditor, and if approved, it resolves a debt without further payment from the borrower. In this article, we will examine how to complete Form 1150 – Offer in Compromise, discuss eligibility requirements for submitting an offer, and look at what forms of payment are accepted.

Download SBA Form 1150 – Offer in Compromise

| Form Number | SBA Form 1150 |

| Form Title | Offer in Compromise |

| File Size | 23 KB |

| Form By | SBA Forms |

What is a SBA Form 1150?

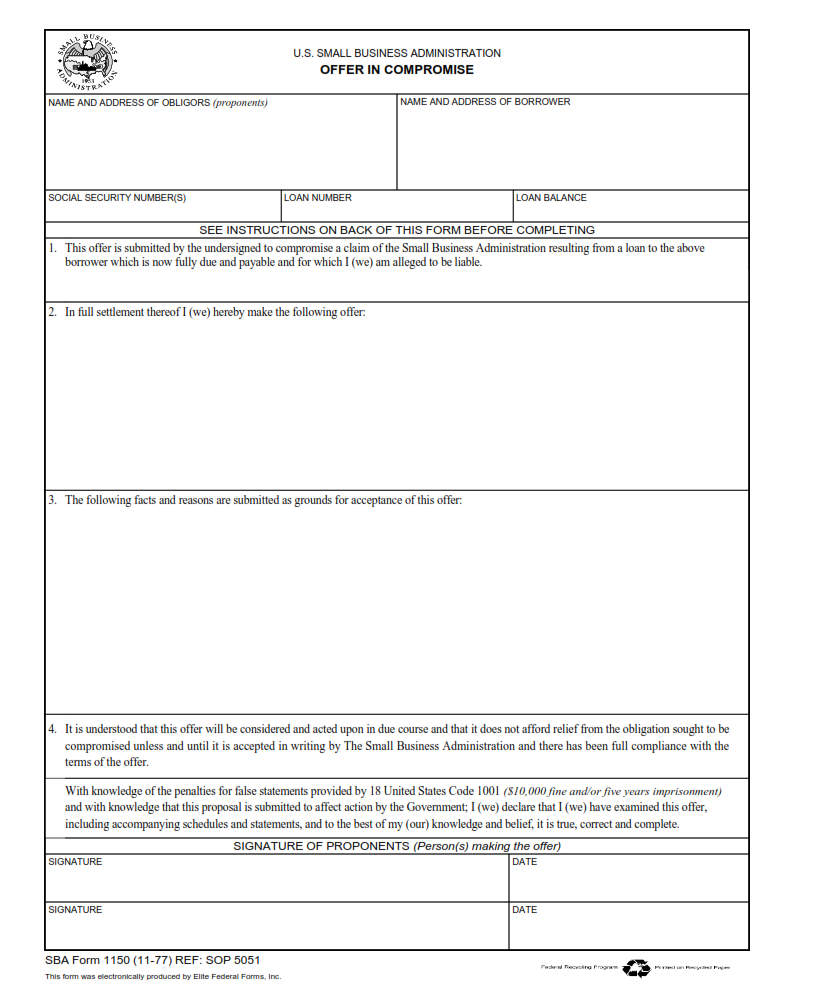

A SBA Form 1150, also known as an Offer in Compromise, is a form created by the US Small Business Administration (SBA). This form allows small businesses to make a proposal for settling their debts to the government. The offer can be made if the business owner has financial difficulties and cannot pay the full amount owed. It allows the business owner to negotiate with creditors to settle their debt for less than what is owed.

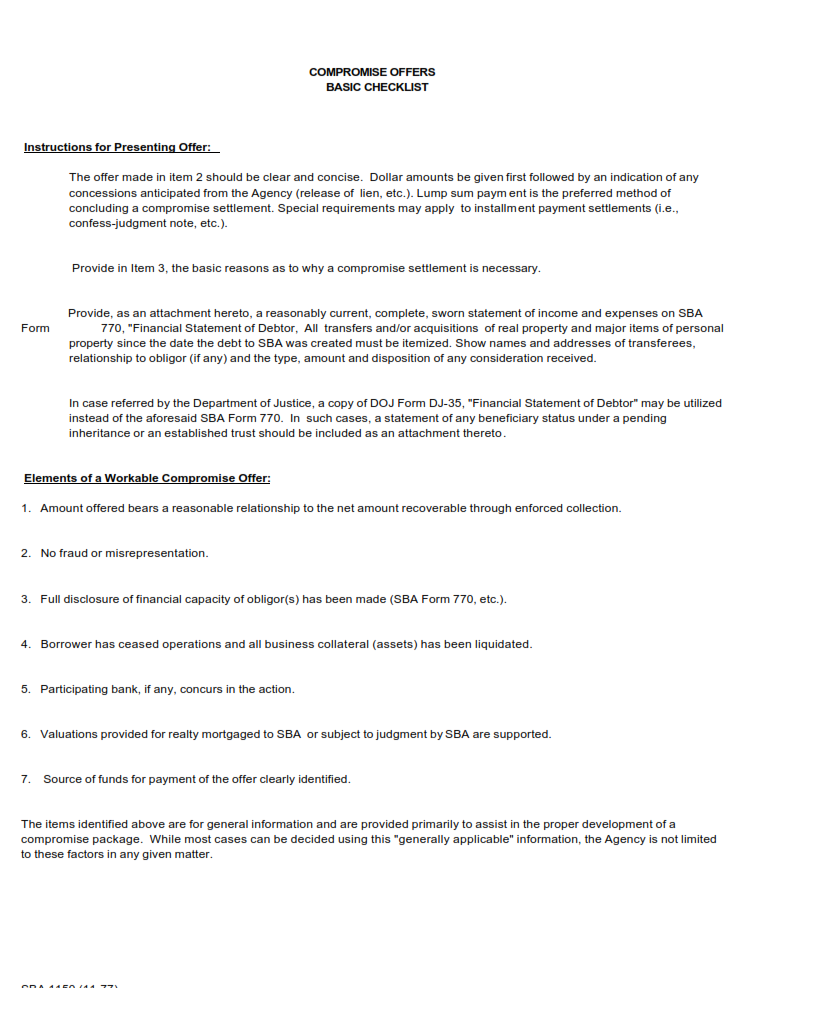

The SBA Form 1150 includes information on how much money is being offered and why it should be accepted by creditors. The form also includes supporting documentation that shows why a certain debt should be forgiven or reduced. Additionally, it includes a statement of financial condition so that creditors can assess whether they believe the business owner can realistically repay any debt that is not forgiven or reduced.

What is the Purpose of SBA Form 1150?

The purpose of SBA Form 1150 is to submit an offer in compromise. An offer in compromise allows borrowers who qualify to settle their debt with the Small Business Administration (SBA) for less than the full amount. This form must be submitted along with supporting documentation that proves the borrower’s inability to pay the loan in full.

For example, if a borrower has gone through financial hardship such as loss of income or business closure, they may submit Form 1150 and prove that paying back the loan would be too great of a burden. This form is also used by borrowers who cannot afford to make payments on their SBA loans due to unfavorable economic conditions, such as high unemployment rates or natural disasters.

Where Can I Find a SBA Form 1150?

The SBA Form 1150, or Offer in Compromise, is an important document for businesses seeking to settle a debt with the Small Business Administration (SBA). This form allows businesses to make an offer of payment that is less than the full debt amount due. To obtain this form and submit an offer, a business must complete several steps.

First, businesses must contact their local SBA district office. The office will provide information about how to submit an Offer in Compromise, as well as instructions on how to fill out the SBA Form 1150. A business may also be required to provide additional documentation such as financial information and proof of hardship.

SBA Form 1150 – Offer in Compromise

The SBA Form 1150 – Offer in Compromise is a form used by the Small Business Administration (SBA) to accept an offer from a borrower to settle their debt for less than what is owed. This type of agreement can be beneficial for both the borrower and lender, as it allows both parties to come to an agreement that works for them.

Under this form, borrowers can submit an offer that outlines how much they’d like to pay back on their loan and why. The lender then has the choice either accept or reject the offered amount. If accepted, the lender will typically agree that no further payments are required beyond what was agreed upon in the offer letter. It’s important to keep in mind that if the offer is rejected, then borrowers may face additional fees or penalties imposed by the lender.

SBA Form 1150 Example