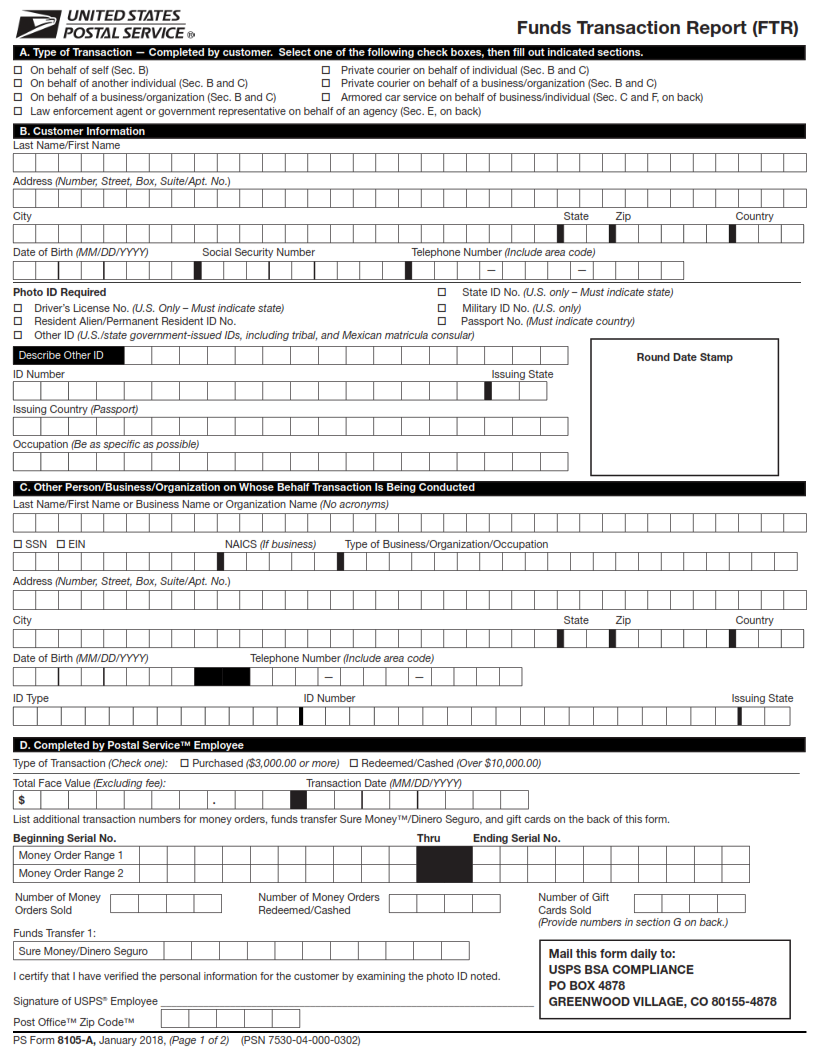

ORIGINFORMSTUDIO.COM – PS Form 8105-A – Funds Transaction Report (FTR) – The PS Form 8105-A, also known as the Funds Transaction Report (FTR), is a vital document used by businesses and organizations to record and track financial transactions. This form helps to ensure accurate accounting of funds for internal audits, taxation purposes, and other bookkeeping tasks. It is important for entities to understand the form’s purpose, contents, and how to complete it correctly in order to remain compliant with government regulations.

Download PS Form 8105-A – Funds Transaction Report (FTR)

| Form Number | PS Form 8105-A |

| Form Title | Funds Transaction Report (FTR) |

| File Size | 130 KB |

| Form By | USPS Forms |

What is PS Form 8105-A?

PS Form 8105-A is a Funds Transaction Report (FTR) used to document cash transactions that exceed $10,000. This form is required by the United States Postal Service for all financial transactions that involve the sale of money orders, traveler’s checks or other monetary instruments. The FTR helps to prevent financial crimes such as money laundering and terrorist financing by identifying suspicious activity.

The PS Form 8105-A requires the seller or agent to provide detailed information about the transaction, including the name and address of the purchaser, identification documentation number and type, date of birth and occupation. It also includes details about the monetary instrument sold, such as serial numbers for traveler’s checks or money orders purchased.

Failure to complete this form can result in penalties or fines, so it is important for postal service employees and agents to understand how to properly complete it. Utilizing PS Form 8105-A helps protect against financial crime while ensuring compliance with federal regulations for monetary instrument sales at USPS locations.

What is the Purpose of PS Form 8105-A?

PS Form 8105-A, also known as the Funds Transaction Report (FTR), is a document used by the United States Postal Service (USPS) to report any cash transactions exceeding $10,000. The purpose of this form is to comply with the Bank Secrecy Act (BSA) and Anti-Money Laundering laws to prevent illegal financial activities such as money laundering, terrorist financing, and tax evasion.

The FTR must be completed by USPS employees who handle cash transactions over $10,000 on behalf of customers. These transactions could include money order purchases or cashing checks that exceed the threshold amount. The form includes details such as the name and address of both parties involved in the transaction, the date of the transaction, amount involved, and other pertinent information.

By requiring USPS employees to complete PS Form 8105-A for large cash transactions, it helps ensure transparency in financial dealings and promotes accountability within its ranks. This document serves as an important tool in preventing fraudulent or illegal activity while ensuring that all postal services are conducted with integrity.

Where Can I Find a PS Form 8105-A?

PS Form 8105-A, also known as the Funds Transaction Report (FTR), is a document required by the US government for reporting any international monetary transactions. This form is used to track financial activities such as wire transfers, checks, and cash deposits that exceed $10,000 in value. If you need to send or receive money from abroad or conduct a large transaction within the United States, you will likely require this form.

To obtain PS Form 8105-A, you can visit your local post office or download it online from the official USPS website. The form is available in both printable and fillable PDF formats. Additionally, some banks and financial institutions may have copies of this form available for their customers.

It’s important to note that filling out PS Form 8105-A correctly is crucial to avoid potential legal issues. If you’re unsure about how to complete this document accurately or if it applies to your specific situation, consider consulting with a financial advisor or tax professional before submitting it.

PS Form 8105-A – Funds Transaction Report (FTR)

PS Form 8105-A, also known as the Funds Transaction Report (FTR), is a form used by financial institutions to report any transaction that involves the movement of funds exceeding $10,000. The FTR is required by law under the Bank Secrecy Act (BSA) and its purpose is to prevent money laundering and other illicit activities.

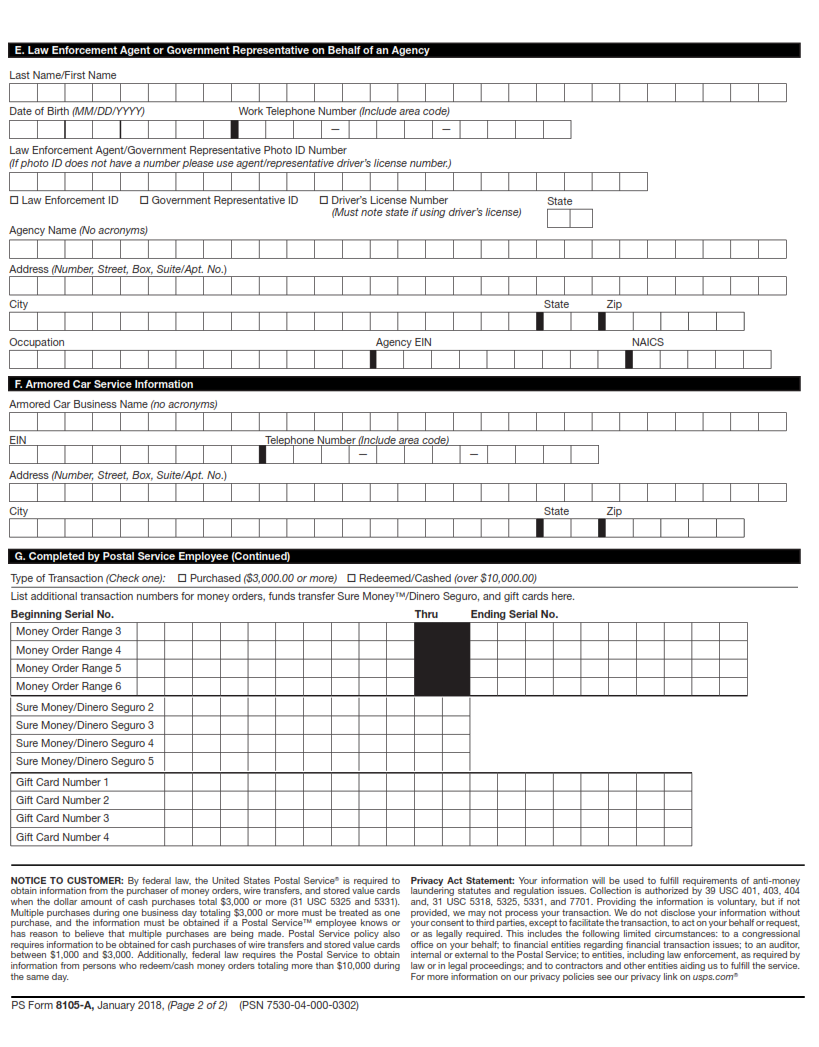

The information provided on the FTR includes details about the transaction such as the name and address of both parties involved, account numbers, transaction amounts, and purpose of the transaction. Financial institutions are required to keep records of all FTRs for five years from the date they were filed.

To ensure compliance with BSA regulations, financial institutions must have procedures in place for identifying transactions that require an FTR report. Failure to file an accurate or timely FTR can result in severe penalties including fines or imprisonment. Therefore, it is important for financial institutions to have a thorough understanding of PS Form 8105-A and its requirements.

PS Form 8105-A Example