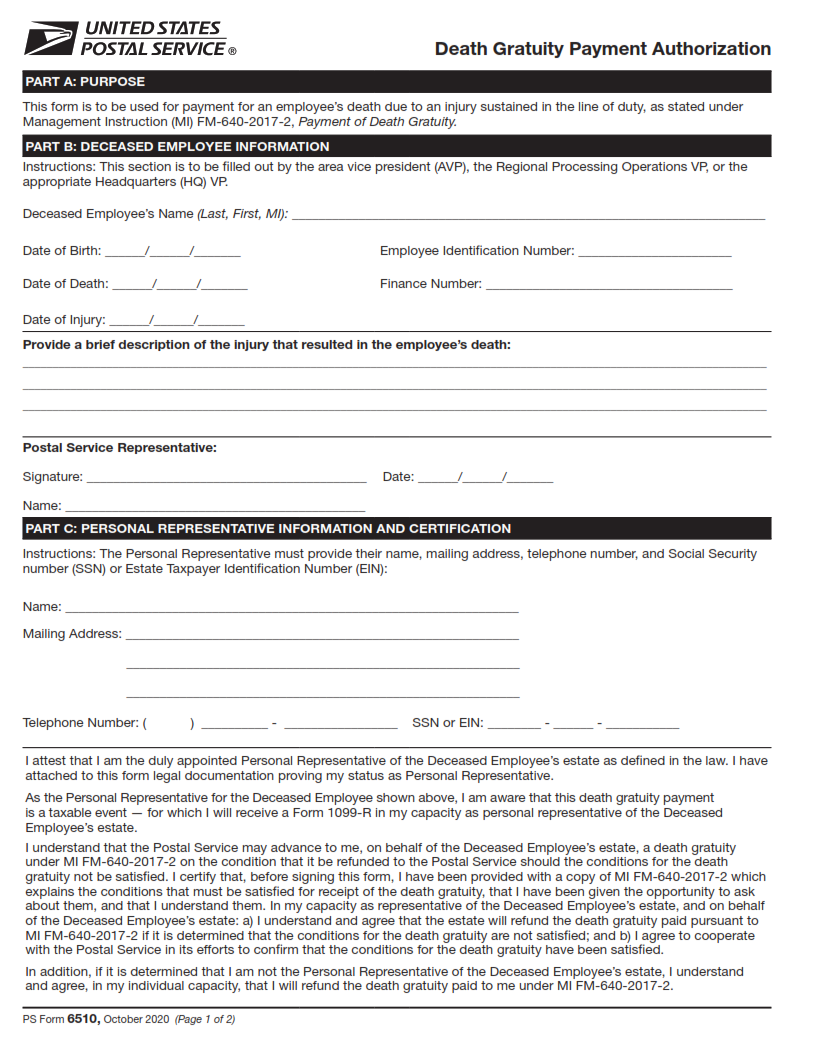

ORIGINFORMSTUDIO.COM – PS Form 6510 – Death Gratuity Payment Authorization – The death of a loved one is a difficult and heartbreaking experience for all family members. In order to support survivors in their time of mourning, the United States government has set forth regulations for providing financial assistance through death gratuity payments. This article will provide an overview of PS Form 6510 – Death Gratuity Payment Authorization, which is the form necessary to apply for a death gratuity payment from the Department of Defense.

Download PS Form 6510 – Death Gratuity Payment Authorization

| Form Number | PS Form 6510 |

| Form Title | Death Gratuity Payment Authorization |

| File Size | 37 KB |

| Form By | USPS Forms |

What is a PS Form 6510?

PS Form 6510 is a United States Postal Service document that authorizes the payment of death gratuity benefits to eligible survivors of USPS employees who have died in service. The death gratuity benefit is a lump sum payment equal to one year’s salary, which may be paid out to the designated survivor(s) within 30 days of the employee’s death.

To initiate a PS Form 6510, the deceased employee’s supervisor must complete and submit it along with appropriate documentation (such as a certified copy of the death certificate and proof of relationship to the designated survivor). After review and approval by USPS, payment can be made.

It should be noted that PS Form 6510 only applies to USPS employees who are not covered by federal retirement programs. For those who are covered by such programs, their beneficiaries may receive more comprehensive benefits from those programs instead.

What is the Purpose of PS Form 6510?

PS Form 6510 is an important document that serves as a Death Gratuity Payment Authorization. This form is primarily used by the United States Postal Service (USPS) to process payments in case of the death of an employee. The purpose of this form is to authorize payment of a death gratuity and provide information about the deceased employee, such as their name, social security number, date of birth, and date of death.

The death gratuity payment authorized by PS Form 6510 is a one-time payment made to eligible beneficiaries upon the death of a federal employee. The amount paid depends on the length of service and pay grade at which the deceased was at before their passing. This gratuity can help cover some burial expenses or provide financial assistance to those left behind.

The USPS requires this form to be completed as soon as possible after an employee’s passing. It must be filled out accurately and completely by an authorized person who has knowledge about the deceased employee’s personal information and employment details. After processing and approval by USPS officials, payments are typically made within four weeks from the date that all required documentation has been submitted.

Where Can I Find a PS Form 6510?

PS Form 6510 is a document used by the United States Postal Service to authorize payment of death gratuity benefits to eligible beneficiaries. This form is only applicable for use if the employee dies while on duty or working for USPS, and its purpose is to provide financial assistance to the family members of the deceased.

To obtain PS Form 6510, individuals can visit their local post office or go online to the official USPS website. The form can be downloaded in PDF format and printed out. Alternatively, users can request a copy of this form by reaching out directly to USPS customer service.

It’s important to note that not everyone is eligible for death gratuity benefits from USPS. These payments are reserved for specific employees who have met certain criteria, including having worked for USPS at least one year before passing away and having had no previous history of misconduct leading up to their death.

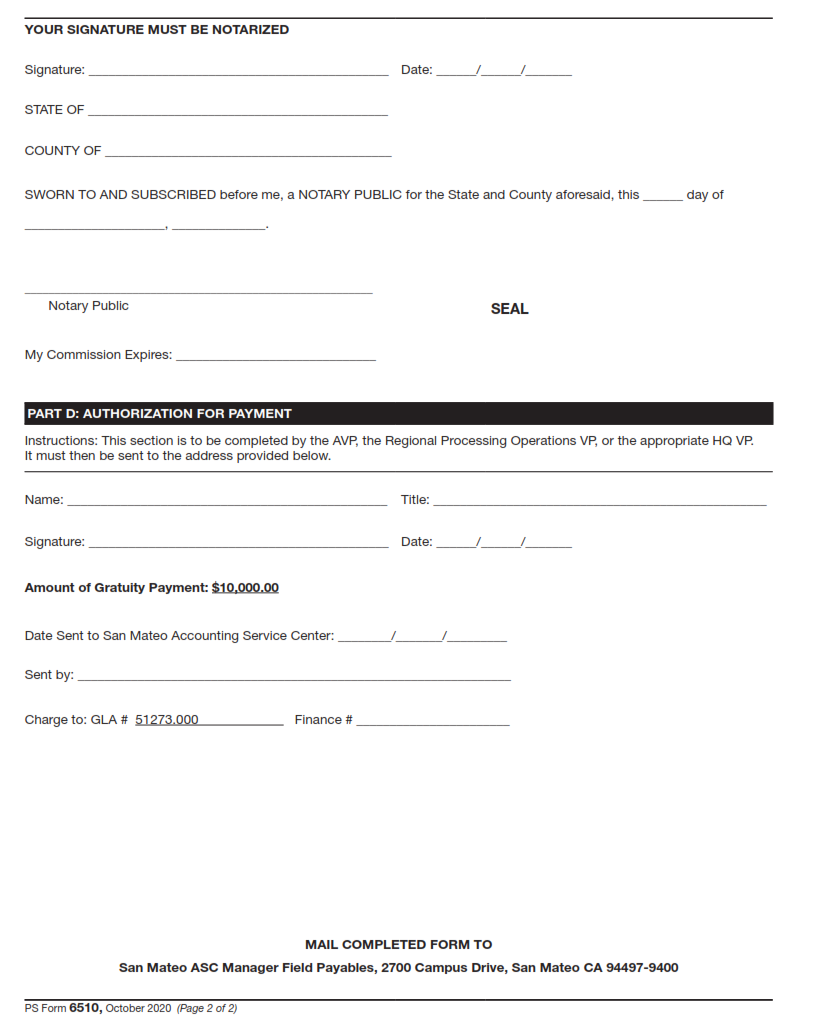

PS Form 6510 – Death Gratuity Payment Authorization

When a federal employee passes away, their family members may be eligible for a death gratuity payment. The PS Form 6510 is used to authorize this payment and must be completed by the appropriate agency official or supervisor. This form requires various personal information about the deceased individual, including their name, address, social security number, and date of birth.

Additionally, the form asks for details about the employee’s job position and salary at the time of their death. It also requires information about any other benefits or insurance policies that may be available to the family members. Once all necessary information has been gathered and verified, the authorized agency official can sign off on the form and submit it for processing.

It is important to note that there are certain eligibility requirements for receiving a death gratuity payment. These include being an active federal employee at the time of passing or having been separated from service due to disability retirement. Furthermore, only certain family members are eligible to receive these payments, such as spouses and children under certain age limits.

PS Form 6510 Example