ORIGINFORMSTUDIO.COM – PS Form 2937 – Importer’s Objections – The United States Customs and Border Protection (CBP) requires importers to use PS Form 2937 when submitting objections to certain CBP decisions. This form can be used by both domestic and foreign entities, as it provides a way for companies or individuals to dispute certain determinations made by CBP that affect their imports. Understanding how to properly fill out the PS Form 2937 is an important part of being an effective importer, as incorrect or missing information may result in delays or other issues with importing goods into the US.

Download PS Form 2937 – Importer’s Objections

| Form Number | PS Form 2937 |

| Form Title | Importer’s Objections |

| File Size | 457 KB |

| Form By | USPS Forms |

What is a PS Form 2937?

A PS Form 2937 is a document issued by the United States Customs and Border Protection (CBP) that serves as an objection to the importation of goods into the country. This form is commonly used when importers fail to comply with CBP regulations, such as providing inaccurate information or failing to provide proper documentation. It also serves as a warning of potential consequences for violations of CBP laws or regulations.

In some cases, a PS Form 2937 may be sent along with additional documents such as a Notice of Detention or Seizure if CBP has reason to believe that goods are entering the country in violation of U.S. law or regulation. The form includes contact information for both the importer and CBP so that any disputes can be addressed quickly and efficiently.

What is the Purpose of PS Form 2937?

PS Form 2937, also known as the Importer’s Objection form, is a document used by U.S. Customs and Border Protection (CBP) to record objections or protests from an importer regarding a CBP action or decision. This form provides a formal process for importers to object to any issues they have with CBP action concerning their shipment. The purpose of this form is to provide an opportunity for importers to express their concerns and dispute any actions taken by CBP that could be in violation of trade regulations set out by the government.

The Importer’s Objections form must be filled out completely and accurately in order for it to be accepted and processed by CBP. Once submitted, the form will then be reviewed by the proper authorities who will determine whether further investigation should take place or if corrective action needs to be taken on behalf of CBP.

Where Can I Find a PS Form 2937?

The U.S. Customs and Border Protection (CBP) requires the submission of PS Form 2937, “Importer’s Objections,” for importers who need to object to an entry or classification decision. This form is available on the CBP website as a downloadable PDF file and can also be requested from any local CBP office in hard copy form.

In order to complete the form, importers must provide detailed information regarding their objections including a description of the merchandise, its value, country of origin, applicable law/statutes and other relevant facts related to their case. The completed form should be filed with all necessary supporting documentation within 15 calendar days from the date that it was issued by CBP in order for it to be considered valid.

PS Form 2937 – Importer’s Objections

PS Form 2937 – Importer’s Objections is used by importers to issue a formal objection to U.S. Customs and Border Protection (CBP) rulings on importation issues that the importer believes are incorrect or incomplete. This form is necessary when an importer wishes to contest a ruling, including but not limited to classification, value, rate of duty, country of origin and marking. The form must be filed within 90 days from the date of issuance which is printed on the CBP ruling in order for it to be considered valid.

In order to file this form, three pieces of information are required: the Customs ruling number; detailed explanations about why the objection has been made; and any documentation related to the decision that needs to be reviewed.

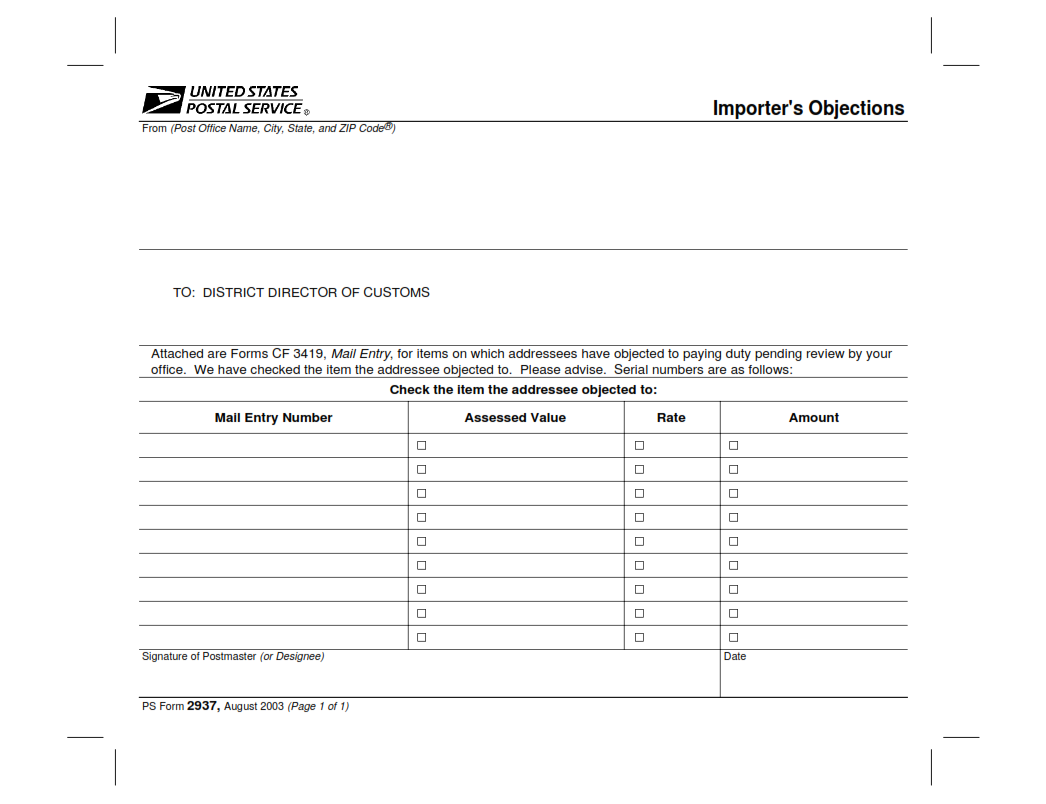

PS Form 2937 Example