ORIGINFORMSTUDIO.COM – DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA) – Remission of indebtedness (LRA) is a debt relief initiative by the Department of Agriculture, Fisheries and Food (DAFF). The LRA scheme was introduced in 2001 and provides for the discharge of government debts by way of compensation to the creditors. Under the scheme, DAF offers creditors written agreements concerning the remittance of their debt.

Download DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

| Form Number | DAF Form 2451 |

| Form Title | Financial Statement – Remission Of Indebtedness (LRA) |

| File Size | 1 MB |

| Form By | 13 -12- 2022 |

What is a DAF Form 2451?

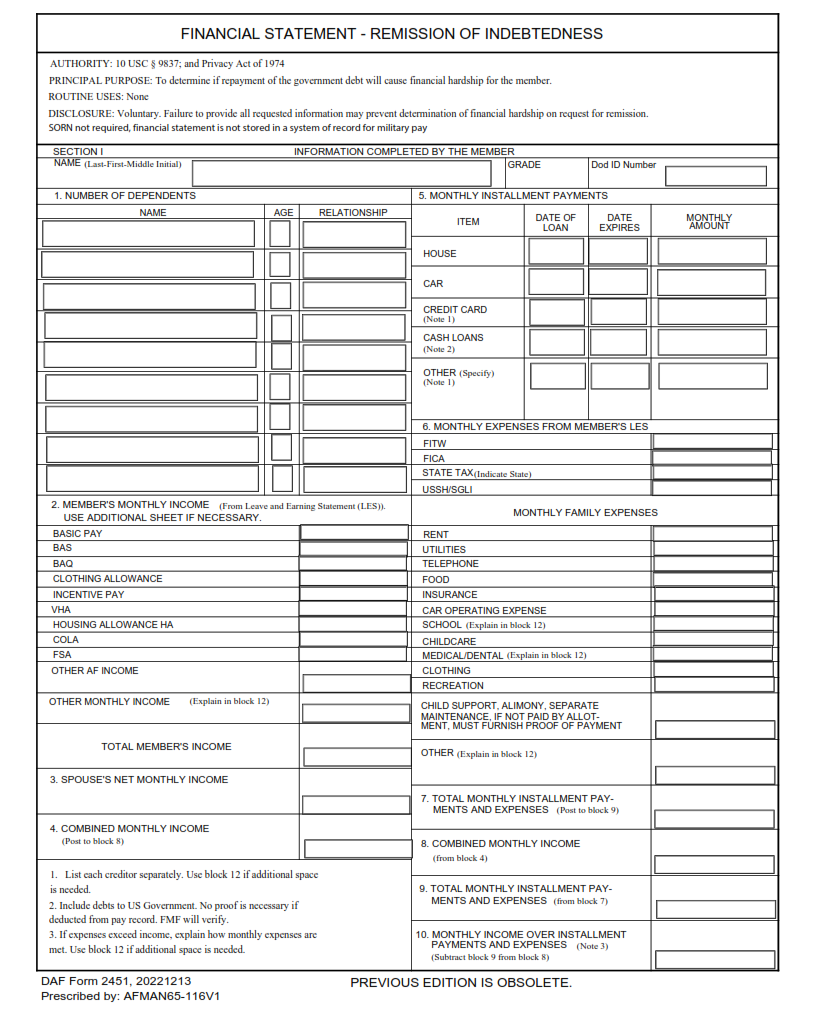

A DAF Form 2451 is a financial statement form used in remission of indebtedness under the Land Reform Act (LRA). The purpose of this form is to provide a detailed report of a debtor’s income, assets, and liabilities. This information helps determine whether the debtor qualifies for debt forgiveness or reduction.

The DAF Form 2451 requires you to fill out your personal information, such as name and address, along with your current employment status. In addition, you’ll be required to list all sources of income received within the past six months. Furthermore, you’ll need to provide a record of all outstanding debts and any assets that could potentially be sold to pay off these debts.

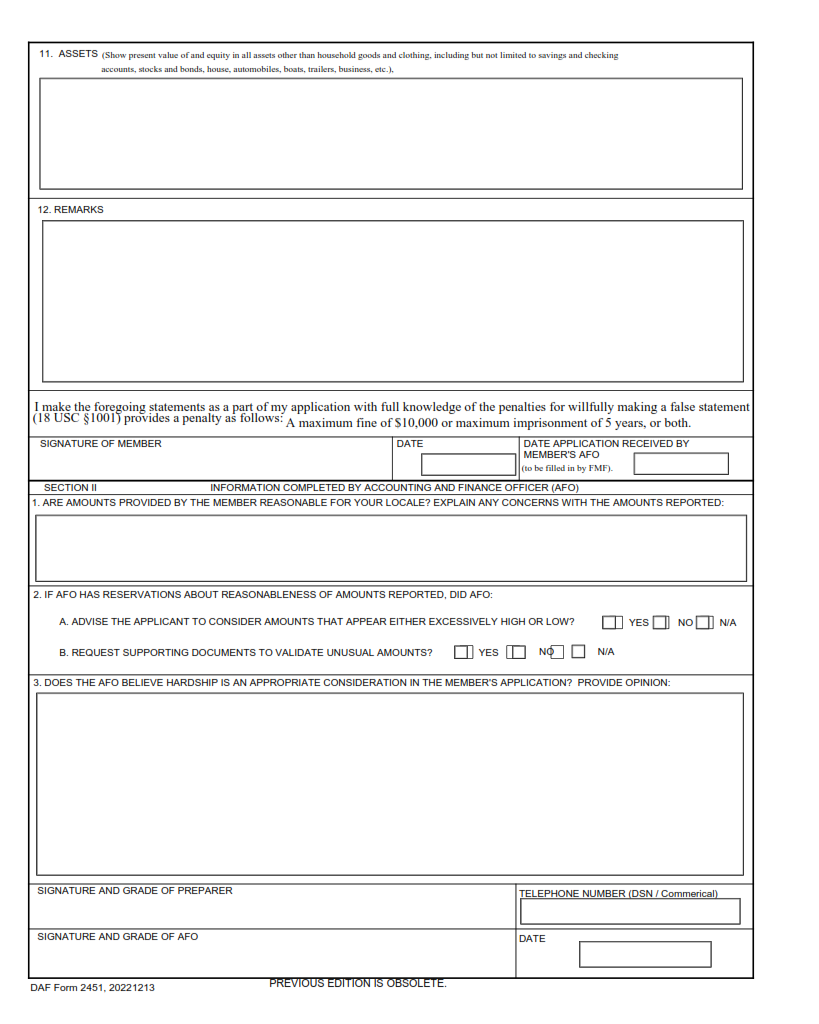

Overall, completing the DAF Form 2451 can be a complex process and it’s important that all details are accurately filled out. Failure to do so may result in disqualification from debt relief programs or even legal repercussions.

What is the Purpose of DAF Form 2451?

DAF Form 2451 is a financial statement that serves the purpose of investigating and providing evidence of remission of indebtedness. The form is used by the Department of the Air Force (DAF) to determine if an individual who has received debt relief, such as loan forgiveness or cancellation, needs to report it as income on their tax return. This applies to individuals who have had part or all their debts forgiven for any reason.

The DAF Form 2451 requires individuals to provide detailed information about the debt that was discharged or cancelled and any assets owned at the time of cancellation. Additionally, it asks for details about any income earned during that year and other sources of income. This information helps the government determine if a portion or all of the cancelled debt should be included in taxable income.

In conclusion, DAF Form 2451 is essential in ensuring transparency and accountability in reporting canceled debts as taxable income. Failure to report this could lead to legal action against individuals who fail to comply with tax laws. It’s crucial for borrowers who have had debts forgiven either partially or wholly by lenders or creditors, especially those under LRA programs, to understand why they need to complete this form accurately and truthfully.

Where Can I Find a DAF Form 2451?

DAF Form 2451 is a financial statement that is required when applying for remission of indebtedness. This form is used to determine if an individual or a business entity qualifies for debt forgiveness from the government. The form requires detailed information about the applicant’s income, expenses and assets.

To obtain DAF Form 2451, individuals can go directly to their local Department of the Army (DA) finance office or download it online from the Defense Finance and Accounting Service (DFAS) website. The form contains instructions on how to fill it out correctly, but individuals may also seek assistance from their finance office if they need additional help.

It’s important for applicants to submit accurate information on DAF Form 2451 as any discrepancies can delay the review process or even lead to disqualification. It’s also important for them to understand that submitting this form does not automatically guarantee that they will receive debt forgiveness but rather it starts the process of determining eligibility.

DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

DAF Form 2451 is a Financial Statement that serves as a Remission of Indebtedness for the Low-Risk Agreement (LRA). This form is used when an employee owes money to the government, and the employer has agreed to remit the debt on their behalf. In such cases, employers are required to fill out this form and submit it to the appropriate authority.

The DAF Form 2451 contains important information about the debt owed by an employee, including its total amount and payment terms. It also requires employers to provide details about their financial situation, including their assets, liabilities, and income. This information helps determine if an employer can afford to pay off an employee’s outstanding debts.

Submitting a completed DAF Form 2451 is essential for employees who want their debts remitted. Failure to do so may result in penalties or legal action against both parties involved in the agreement. Therefore, employees must ensure that all necessary details are provided accurately on this form before submitting it for processing.

DAF Form 2451 Example