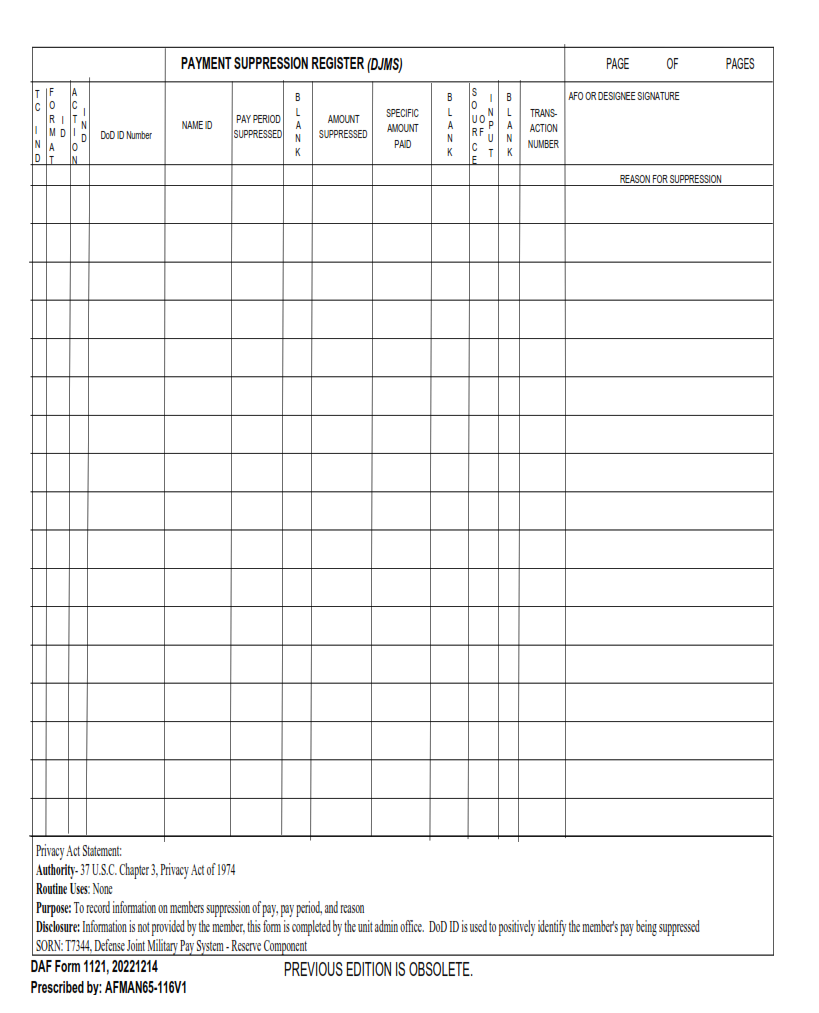

ORIGINFORMSTUDIO.COM – DAF Form 1121 – Payment Suppression Register (Jumps) – The DAF form 1121 – Payment Suppression Register (Jumps) is used to track payments that are suppressed due to violations of applicable payment suppression regulations. The form includes column headings for the reasons for payment suppression, the dates and amounts of the payments, and the name and contact information of the person who made the payment.

Download DAF Form 1121 – Payment Suppression Register (Jumps)

| Form Number | DAF Form 1121 |

| Form Title | Payment Suppression Register (Jumps) |

| File Size | 41 KB |

| Form By | USPS Forms |

What is a DAF Form 1121?

DAF Form 1121 is a payment suppression register that is used to identify and track jumps in payment amounts. A jump occurs when there is a significant increase or decrease in the amount of payment made for a particular transaction. These jumps can be indicative of fraudulent activity or errors, such as double payments or incorrect billing amounts.

The purpose of the Payment Suppression Register (Jumps) is to prevent fraud and ensure accurate financial reporting. By tracking these jumps in payment amounts, organizations can quickly identify and investigate any suspicious activity before it becomes a larger issue. The DAF Form 1121 also helps businesses comply with regulatory requirements by providing documentation of payment tracking efforts.

Overall, the use of DAF Form 1121 is an important tool for companies looking to maintain financial integrity and minimize risk. By monitoring for jumps in payment amounts, businesses can stay ahead of potential problems and ensure that their financial records are accurate and transparent.

What is the Purpose of DAF Form 1121?

DAF Form 1121, also known as the Payment Suppression Register (Jumps), serves a crucial purpose in maintaining financial records. The form is used by the Defense Finance and Accounting Service (DFAS) to document any discrepancies found during auditing of military payroll accounts. Specifically, the form is used to track instances where payments were suppressed or not made on time.

The information on DAF Form 1121 is entered into a database that helps identify trends and patterns in payment errors. This data can then be used to improve processes and prevent future payment issues. Additionally, the form helps ensure compliance with federal laws regulating government financial management.

Overall, DAF Form 1121 plays an important role in maintaining accurate financial records for military personnel. By identifying and correcting payment errors, DFAS can ensure that service members receive their proper pay in a timely manner while also maintaining transparency and accountability in government finances.

Where Can I Find a DAF Form 1121?

DAF Form 1121 is a Payment Suppression Register (Jumps) used by the Department of Defense to report any payment that has been deliberately withheld or delayed. This form is essential for anyone who is involved in government contracts with the Department of Defense, as it helps ensure that payments are made on time and without any interruption.

To find this form, you can visit the official website of the Department of Defense, where all forms related to government contracts are available for download. You can also contact your contracting officer, who will be able to provide you with a copy of this form or point you in the right direction to obtain one.

It’s important to note that DAF Form 1121 must be completed accurately and submitted on time to avoid any issues with payment processing. As such, it’s advisable to familiarize yourself with this form and its requirements before entering into a contract with the Department of Defense.

DAF Form 1121 – Payment Suppression Register (Jumps)

DAF Form 1121, also known as the Payment Suppression Register (Jumps), is a document used by the Department of the Air Force to monitor and prevent payment errors. The form contains a list of vendor payments that have been suppressed or stopped due to issues such as incorrect payment amounts or missing documentation.

The Payment Suppression Register helps ensure that payments are made accurately and efficiently, reducing the risk of financial losses for both vendors and the Air Force. By using this form, potential payment errors can be identified early on, allowing for quick resolution before any funds are disbursed. This not only saves time and money but also helps maintain compliance with financial regulations.

In summary, DAF Form 1121 serves as an essential tool in preventing payment errors within the Department of the Air Force. It allows for effective monitoring and management of vendor payments while ensuring compliance with financial regulations.

DAF Form 1121 Example